February Summary

- For a more detailed recap of the reasons behind the share market fall in February, please read our Mid-February Update included in the January Summary.

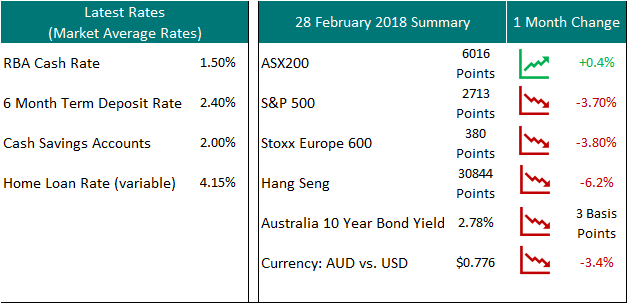

- Global shares fell 3.6% in February largely reversing January’s gains. In America the Dow Jones experienced its largest daily fall since December 2008 during the financial crisis while the S&P500 experiencing their worst weeks since January 2016. European markets took large dives with the German DAX Index falling 5.7% and the Italy MIB30 Index falling 3.8%. Asian markets performed even worse with the Shanghai Composite falling 6.4% and the HK Hang Seng Index falling 6.2%

- This was as a result of the release of higher than expected US wages growth data in early February, generating concerns that inflation pressures had finally been unleashed became widespread. Despite a rebound as the month progressed, International Shares performed poorly with most markets posting negative returns, however by no means offsetting the positive returns of the previous six months.

- Despite the volatile month due to the sell off on Wall Street, the Australian shares index ended the month increasing by 0.4% following January’s fall of the same amount. The Australian market managed to rally because of positive half-year earnings results. Reporting season saw over a third of earnings results beating market expectations which helped investor confidence.

- In Australia, the unemployment rate fell slightly to 5.5% (from 5.6%), due to part-time employment increasing offsetting the drag from full-time employment.

- Subdued wages growth is a factor holding back household consumption with recent comments by the Reserve Bank suggesting this is now front of mind for public policy makers.

However, while consumer confidence remains lacklustre, business confidence increased in January to be at its highest level in almost 10 years

- Australian listed property returned -3.3% in February, matching January’s decline whilst Global listed property returned -6.4%, with higher bond yields and fears of more to come having a greater impact on property trusts than the broader market

- The Australian dollar reversed in February ending the month at US$0.7762, compared to US$0.8057 a month earlier

- US bond yields moved significantly higher in February as inflation fears surfaced. US 10-year government bond yields ended the month at 2.9% from 2.7% a month earlier.Compiled with BT Applied Research Monthly Commentary – February 2018

This information is of a general nature only and may not be relevant to your particular circumstances. The circumstances of each investor are different and you should seek advice from your financial planner who can consider if the strategies and products are right for you. For more information contact Altitude Advisers on (07) 3209 2300.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.