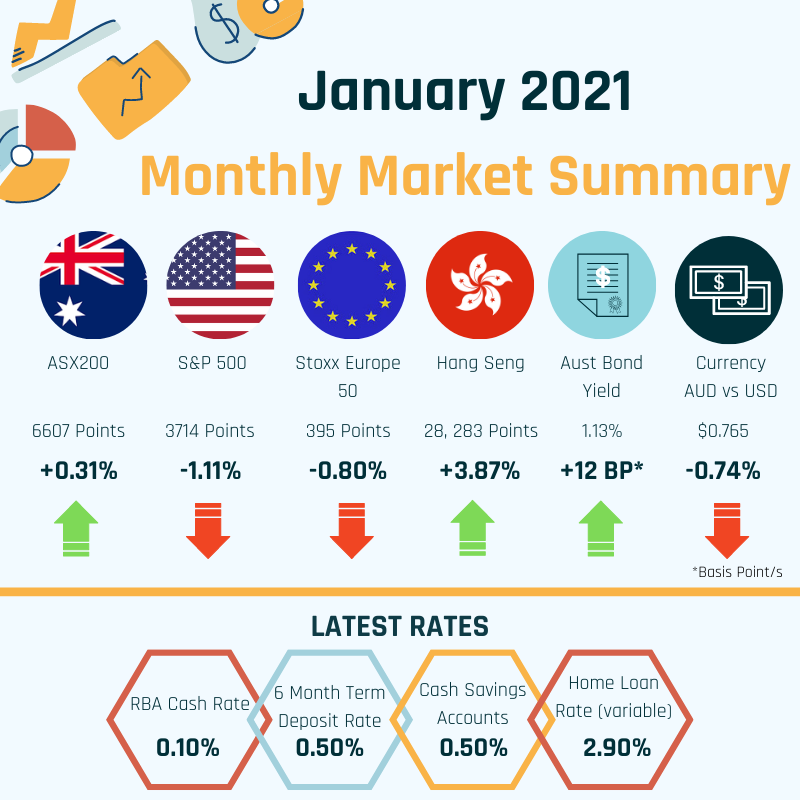

- The growth momentum we saw in 2020 continues to carry over in 2021, with consumer confidence now at highs not seen for a decade, whilst business sentiment is positive and above its long-term average.

- This is anticipated to boost jobs as consumers spend more, particularly in retail, and this gives businesses the confidence to undertake new business activity

- Another large positive for Australia is the current price for iron ore which is above US $160 a tonne. This is well above the average price and what the Federal and State Government’s will have factored for their budget, it will help with taxes and meeting some of the large debts accrued up from COVID-19 stimulus measures.

- Part of the positive growth with the share market is from investors positioning forward for 6 months+ and the expectation the Covid-19 vaccines rollout will have progressed considerably. It is hoped when a sufficient proportion of the community has been vaccinated and the herd-immunity effect can take place, most restrictions for borders/shut downs will be wound back and pent up demand from consumers will help spur growth globally, not just for Australia and Asia, but for Europe and the US in particular.

- Economic data recently released was much better than expected. Particularly with the unemployment rate falling from 6.6% in December to 6.4% in January

- The level of employment in Australia is just 0.5% below its pre-COVID-19 level. However there remains a high level of under-employment (people working but needing more hours) and there is also a lot of uncertainty as to what impact the removal/changes to job keeper payments in March will have on this rate.

- The RBA has noted that for it to consider raising interest rates it needs to see a number of factors improve, this includes;

- Unemployment falling to below 5%.

- Inflation needs to remain sustainably within the target band of 2-3%, currently this is sitting at 0.9.% for the year (but was slightly higher for the September quarter at 1.4%)

- The combination of higher unemployment, low inflation and low wage growth has resulted in the RBA stating that it does not expect that interest rates will start to increase until 2024.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.