Positive earnings and expectations drive volatile but positive markets despite pandemic and political issues.

August saw a turning point in the world’s fight against COVID-19. A large number of developed countries reached vaccinations targets removing lockdowns and restrictions. Europe, the UK and a portion of the US have started returning to more normal operations, boosting markets over August. America’s S&P500 market increasing 3.12%. For these countries, whilst there remains large numbers of daily cases, the populations are generally seeing less severe symptoms (and impacts on healthcare), with expectations that they will not need to reinstate restrictions.

In Australia, investors commenced the month with an optimistic outlook, particularly on better than expected earnings announcements for a large portion of the market. Company earnings were much better than expected for the 2021 financial year or struggling companies losses/low results were not as bad as anticipated. However over the month China announced measures to cut its steel production as part of emission reduction measures which saw iron ore prices decrease significantly. As a result almost half of these gains over the month were given back but the Australian market still finished the month in positive territory, up 1.82%. We continue to anticipate reasonable growth and earnings in the near term, although we expect this at a reduced rate compared to the last 12 months and also dependant on the extent of lockdowns in NSW and Victoria.

With Australia’s major cities remaining or reinstating lockdowns, the slow vaccination rollout has Australia lagging behind many of the aforementioned developed countries. As the vaccine becomes available across all adult age groups, we have seen vaccination numbers drastically increasing with the investors hoping that the medium term rollback of restrictions and lockdowns can remain in place and limit further damage to the economy.

Political issues with the world’s two biggest economies have had differing effects on global share markets. America continues to grapple with the COVID-19 recovery as it sees a re-emergence in a number of higher populated states. Whilst the troubled exit of Afghanistan saw the worst ratings for President Joe Biden’s popularity since taking office, yet the broader market impact was minimal. Conversely in China its Communist party announced a number of significant changes to reign in its large tech companies and educational institutions. It banned companies teaching school curriculum subjects from making profits or listing on global stock exchanges under the goal of making education more affordable. This resulted in many of the leading education company’s shares falling by 60%. Whilst its large tech companies that rival the size and power of Google and Facebook in China face additional regulatory crackdowns, banning services/apps from Chinese online apps stores and significantly curtailing there use, and restricting foreign investment. This also saw significant declines in share prices for investors both in China and internationally.

The unemployment rate hit a 12 year record low of 4.6% during the month of July, however lockdowns are likely to be masking the true extent of unemployment whilst shops and business remain closed and some new job keeper measures have been reintroduced.

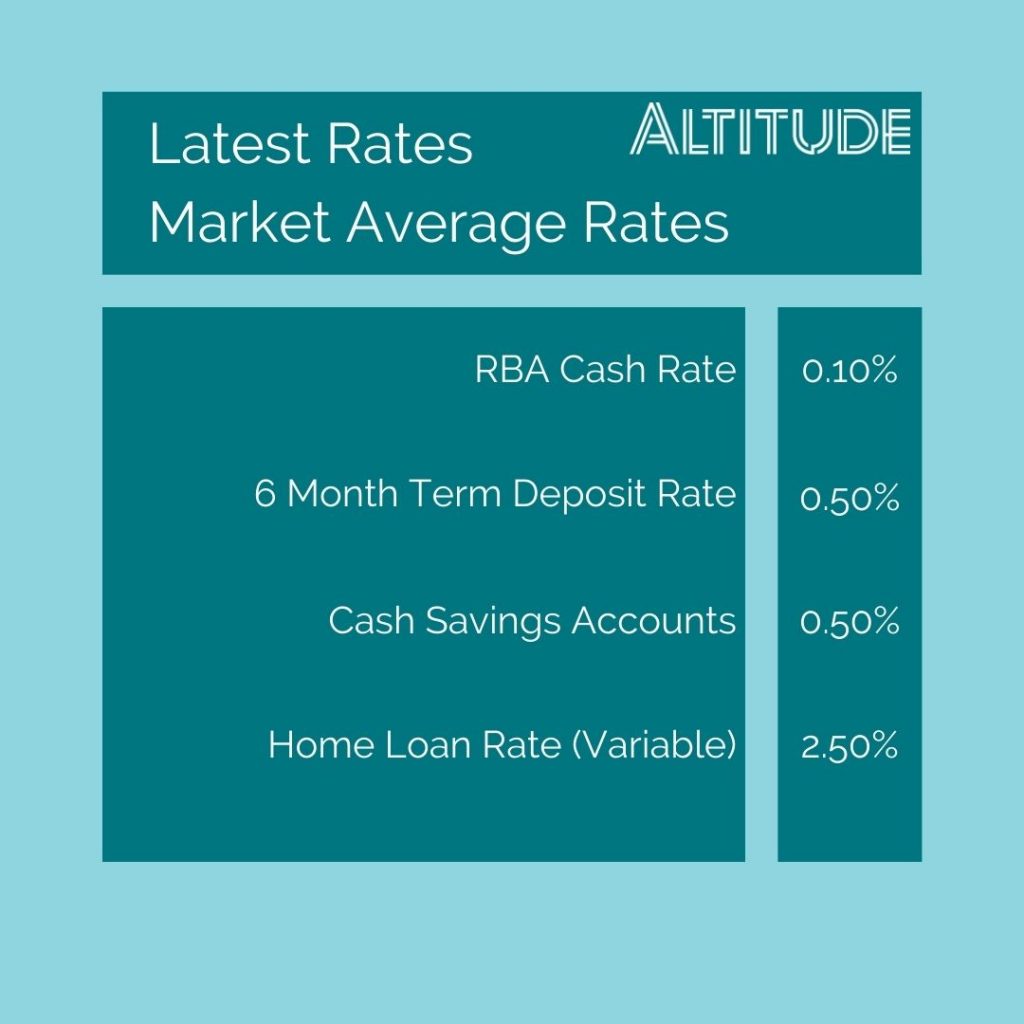

The RBA continues to hold the cash rate at its record low and maintain their stance that it will not increase until inflation is sustainably between 2-3%. With Australia not seeing the inflationary pressure compared to other part of the world, we do not expect the cash rate to increase for at least the next year.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.