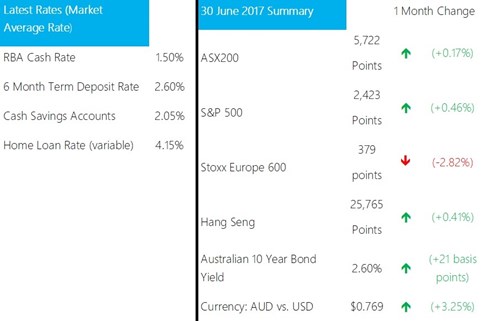

- The Australian Dollar moved higher by 3.25% against the US Dollar through June as key commodities such as Iron ore rebounded (after a sharp correction through May) and negative sentiment in the US Dollar weakening it.

- Global shares posted modest returns over the month of 0.3% however factoring in the stronger Australian dollar, unhedged returns made a loss of -2.5%.

- Australian shares remained fairly stable through June as sharp gains were recorded for the Health Care sector (6.1%) and Financials rebounded (1.6%) following a sharp selloff in May due to the bank levy imposed in the Federal Budget. These gains were also offset by weakness in the Energy sector (-6.9%) given lower oil prices due to an increase in market supply, whilst Listed Property declined 4.8% due to rising bond yields. The Australian economy has remained resilient yet modest. Retail spending and the unemployment rate has been improving, however housing construction appears to be slowing.

- While political uncertainty has been a key factor in 2016, June saw a lot of tension and concern ease. The Conservative Emmanuel Macron won the French election, which doused concerns over a rise in anti-EU populist parties. Additionally, the impeachment of South Korean President Park Geun-Hye was welcomed by Korean investors. However, the British general election as well as North Korea’s ambitious nuclear missile program remain key political concerns looking forward.

- Asian shares proved resilient as strong retail sales continued to provide a boost for Chinese shares. The People’s Bank of China signalled that monetary policy tightening was a near term consideration which caused a selloff in bond-proxy investments such as real estate. Japanese shares made mild gains given improving business confidence and a weaker yen, helping exporters.

- The US Federal Reserve raised rates for the third time in June to 1.25%, which caused a spike in the Australian and US Bond yields. This had a flow on effect, with the Bank of Canada also raising rates to 0.75%. Trump’s bold stimulus promises in an already strengthening economy continue to sway the Federal Reserve to raise rates. While it appears that Australian Bonds are set to remain at it’s current level (with the RBA signalling that it is more likely to keep rates on hold) many interest rates globally are set to rise, which will be a positive for international bond yields.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.