Key points

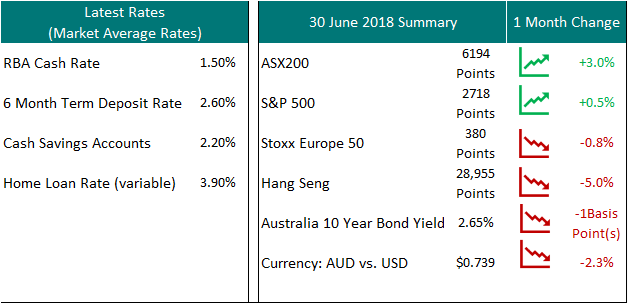

- Despite recent volatility in the Australian share market, the ASX200 had another positive month in June, up a strong 3.3% over June. Despite trade war concerns between the US and various countries, Australian shares at one point in the month reached their highest level since early 2008. This was based on rises from the IT sector (as investors continued to buy up these growth stocks), Energy (as oil prices increased) and listed property also bounced back strongly.

- Exports and earnings generated by Australian companies from overseas will also benefit from the recent fall in the Australian dollar. Trade war concerns saw a dip in commodity prices, and investors worried about what implications this may have for Asian economies also sold down growth assets in this region. The Australia dollar is seen a barometer for these conditions, falling when prices for commodities and emerging Asian stocks decline.

- The RBA left rates unchanged at its June and July meetings, with the cash rate remaining at a record low of 1.5%. The central bank continues to remain positive about economic growth, however, it points out that inflation will likely remain low for some time, consistent with low wage growth. As a result, the cash rate in Australia is not anticipated to change in the next 8-12 months.

- The trade war between China and the US officially start on July 6 when President Trump implemented tariffs on US$50b of Chinese goods, with China retaliating in kind announcing the same level of tariffs on American goods. As part of the original announcement Trump also noted that if China matched US tariffs there would be further tariffs on up to another $500b of goods. With the global economy more intertwined than ever before, it is unchartered territory as to what extent the impact will be, and may result in global growth slowing whilst adding to inflation levels (due to price hikes from tariffs).

- The implementation of the tariffs not only affected Chinese share markets but also other Asian markets in the region with Hong Kong, Taiwan and Korea sold down by investors due to the unknown level of disruption it would have on exports to the US. (It continues to be noted that the tariffs imposed only account for a small portion of Chinese exports to the US, and an even small portion of global trade)

- Conversely, during the same period US share markets were positive, however this was based more on the strong corporate profit story to date, where profits surprised on the up side. The previously announced tax cuts also continued to have a positive effect. Whilst US markets have been resilient so far, further volatility is expected, particularly as future profits may come under pressure as a result of tariffs and/or wage inflation.

- The US Federal Reserve also increased the fed funds rate by 25 basis points to 1.75-2.00% at its June meeting. This is the seventh increase in the current tightening (increasing) cycle that started in December 2015 and the second this year. Expectations are for two more rate hikes this year.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.