Key points

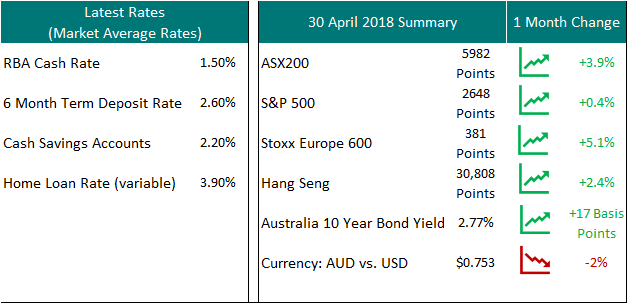

- The Australian economy continues its trend of slower but positive growth. Released over the month of April were the March quarter inflation figures which continues to be just under 2% (on an annual basis). Healthcare and Education had the largest increases whilst Clothing and Recreation/Entertainment actually fell. At the same time new residential building fell whilst non-residential building work increased. Given inflation remains low even with reduced interest rates, and the heat looks to have been taken out of the housing sector, interest rates in Australia are anticipated to remain unchanged for the short-medium term.

- After falling strongly in the March quarter, Australian shares rallied back (up 3.9%), this was primarily a result of oil prices increasing over concerns in the Middle East and this saw Energy shares to increase over 10%; additionally, Healthcare saw strong positive earnings announcements, and Resources/materials benefited from rising commodity prices. Conversely Banks and Financial stocks fell from findings in the Royal Commission. Our outlook remains positive for Australian shares, however as anticipated, volatility is expected to be much more significant compared to last year. Particularly as uncertainty remains around any long-term impacts from the potential trade war with the US and China, and what ramifications the Royal Commission will have on the Banks and Financials sector. Given the Australian share market’s two biggest sectors are Banking and Resources/Materials, these above-mentioned uncertainties will continue to have a disproportional impact on our market compared to other overseas markets.

- International markets were volatile, with a lot of information to digest including geopolitical concerns with the trade war between the U.S. and China and US-led missile attacks in Syria. Additionally, many manufacturing and technology related stocks tumbled on a report suggesting smartphone sales may have peaked, forcing investors to re-evaluate growth for companies in these sectors.

- Combating the negative news where the reports that European markets rallied back from poor returns in the previous quarter based on positive earnings announcements.

- Similarly, US companies also had a very strong earnings reporting season, with more that three quarters of companies that reported beating expectations. However, US markets were only slightly positive as many investors questioned how much further company earnings could continue to grow at current pace if US interest rates increase notably and remove the availability of very cheap lending in the economy. Whilst higher rates are anticipated to have an impact on the US economy, we continue to have a positive outlook with the US economy remaining strong and unemployment at a 17-year low.

- The progressive increase to US interest rates are expected to continue to have a downward impact on the Australian dollar, particularly as our interest rates are anticipated to remain flat for the short-medium term based on Australia’s current economic outlook. This will have a positive effect on overseas earnings/investments within portfolios but increase the cost to imports for the Australian economy

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.