- May saw global markets (excluding Australia) fall strongly in the latter half of the month, primarily around US-China trade talks worsening and the impact it could have on global growth rates, uncertainty was also increased by new tariff threat made by the US to Mexico (and India) and increased uncertainty around negotiations and timing of Brexit in the UK as Prime Minister Theresa May resigned.

- Markets then rallied into June as the US Federal Reserve stated that the central bank would consider accommodative monetary policy (cutting interest rates) to support US economic expansion. It is highly expected that a cut in July will be announced as there was no reduction from the June meeting. It may also be a substantial cut in order to provide a boost to investors, consumers and businesses.

- As noted previously, global growth is expected to remain positive but slower and lower compared to its previous high rates. Over the March quarter Global growth actually improved with data indicating GDP has increased compared to the sharp drop in the second half of 2018. However, trade and manufacturing have remained sluggish.

- The Australian share market was much less affected by International issues and has continued to rise since the election, in particular bank stocks have helped drive the share market closer to its previous all-time highs as a result of less stringent and onerous requirements not being imposed.

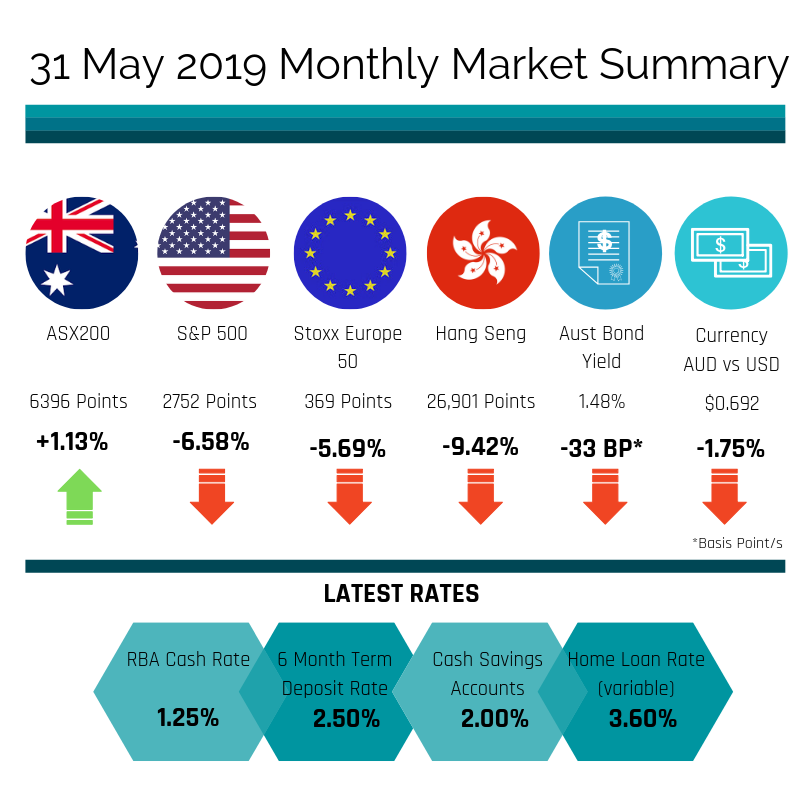

- As expected, the Reserve Bank of Australia cut the cash rate by 25 basis points to a new record low of 1.25% at its June meeting. The bank has indicated that it may reduce rates further (likely one more additional cut) to try and boost the slowing economy, help get inflation up into its targeted 2% to 3% band, and drive unemployment down to 4.5% or below, compared with the current rate which has hovered around 5.2%.

- As part of the decision to lower rates the RBA noted it had deliberated on the impact of lower rates impacting savings, particularly for retirees, however it was expected that a cut would have a broader positive impact on the economy. In particular the RBA hopes the lower rate will encourage business to higher more people; by reducing the unemployment rate it anticipates this will assist in pushing up wages (which have been stagnant), increase inflation and increase spending (very low or negative inflation results in individuals delaying consumption/spending as the purchase may become cheaper in the future, thereby reducing growth within the economy further).

- Fixed interest and government bonds also fluctuated over the period, firstly with bonds rallying as investors looked to the safety of fixed interest as trade tensions worsened, before being offloaded again as rates were expected to be cut in the US, therefore lowering demand.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.