Article By Adam Camac | | Financial Planning

Key points

- May saw the release of the Federal Budget, with key proposals including lower personal income tax rates over the next decade, and a continuing push for a reduction of the corporate tax rate. This announcement had a positive affect on the Australian share market, however the cut to corporate tax rates remains controversial, and at the time of writing was still being negotiated with a range of Senators to gain enough votes to pass, a vote is expected to be taken in the Senate in the next siting in late June. If the tax rates are lowered, this is anticipated to have a further uplifting impact on the Australian share market.

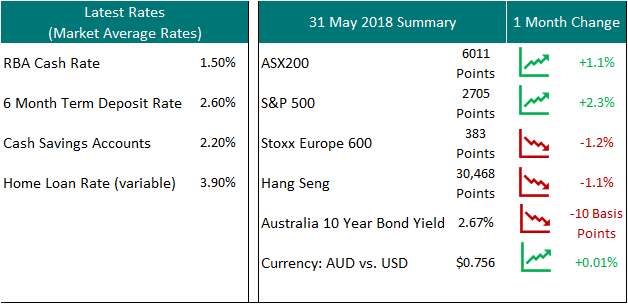

- Over the month of May Australian shares had another positive month (up 1.1%) due to a combination of factors including reduced concerns over trade wars, positive company earnings announcements, and a lower Australia dollar (which remains a positive for tourism and exports). Some of the gains were reduced late in the month over political concerns in Italy and the European Union, which saw some global investors reduce their growth assets.

- In the US, unemployment has fallen below 4% (now 3.8%), investors continue to monitor the effect this is having on wages, however there is yet to be a significant uplift in wages or inflation. Any notable lift in inflation is anticipated to cause the US Federal Reserve to increase interest rates at a pace faster than currently forecast, causing investors to re-consider their market valuations.

- International markets remained positive but volatile, with the MSCI world Index up 1.0% over May. Over the month investors concerns over trade wars started to wane as the US and China held a number of negotiations, however towards the end of the month concerns over Italian elections and its impact on the European Union surfaced, causing European markets to fall and spreading volatility to markets globally.

- For Europe, populist and right-wing parties looked to have taken power in Italy, causing investors to fear Italy will leave the Union and the Euro (i.e. Quitaly). However much like the concerns over Greece a number of years ago, whilst the populist parties are likely to make some noise about potentially upending the system, the economy remains heavily tied to the European Union. They may gain some concessions to ease existing austerity measures for the Italian economy, but are expected to remain in the union; particularly as the EU looks to make it as difficult as possible for the UK to leave the Union.

- Whilst US trade wars had settled somewhat in May, with the commencement of the Group of 7 (G7) meeting in Canada, Trumps looks to have furthered his protectionist agenda causing further issues with European and North American trading partners and reneging and renegotiating deals with China. As a result, uncertainty remains high, however markets look to have become somewhat desensitised to Trumps style of diplomacy and may not react until there are concrete agreements in place.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.