- Markets have risen strongly since the start of November on the back of the US Election results and positive developments regarding vaccines for COVID-19. With a second US vaccine announced as being successful and awaiting final stages approval, markets have been ignoring the escalating cases in America and Europe in the short-term and focusing more towards the middle of next year where many are hoping the vaccine will put an end for the need economic shutdowns.

- Joe Biden has won the US election and is due to be inaugurated on 20 January 2021. President Trump is yet to officially concede and has filed lawsuits in several States claiming voter fraud. From an Investment perspective, markets have welcomed the election outcome as the strong sweep of Democratic seats (expected from many groups) did not eventuate. This means the Biden administration will need to work with both the House and Senate to pass legislation, with any controversial policies such as significant tax increases unlikely to be proposed.

- The US continues to struggle with COVID-19 cases with several States going back into lockdown, which is stalling the country’s economic recovery.

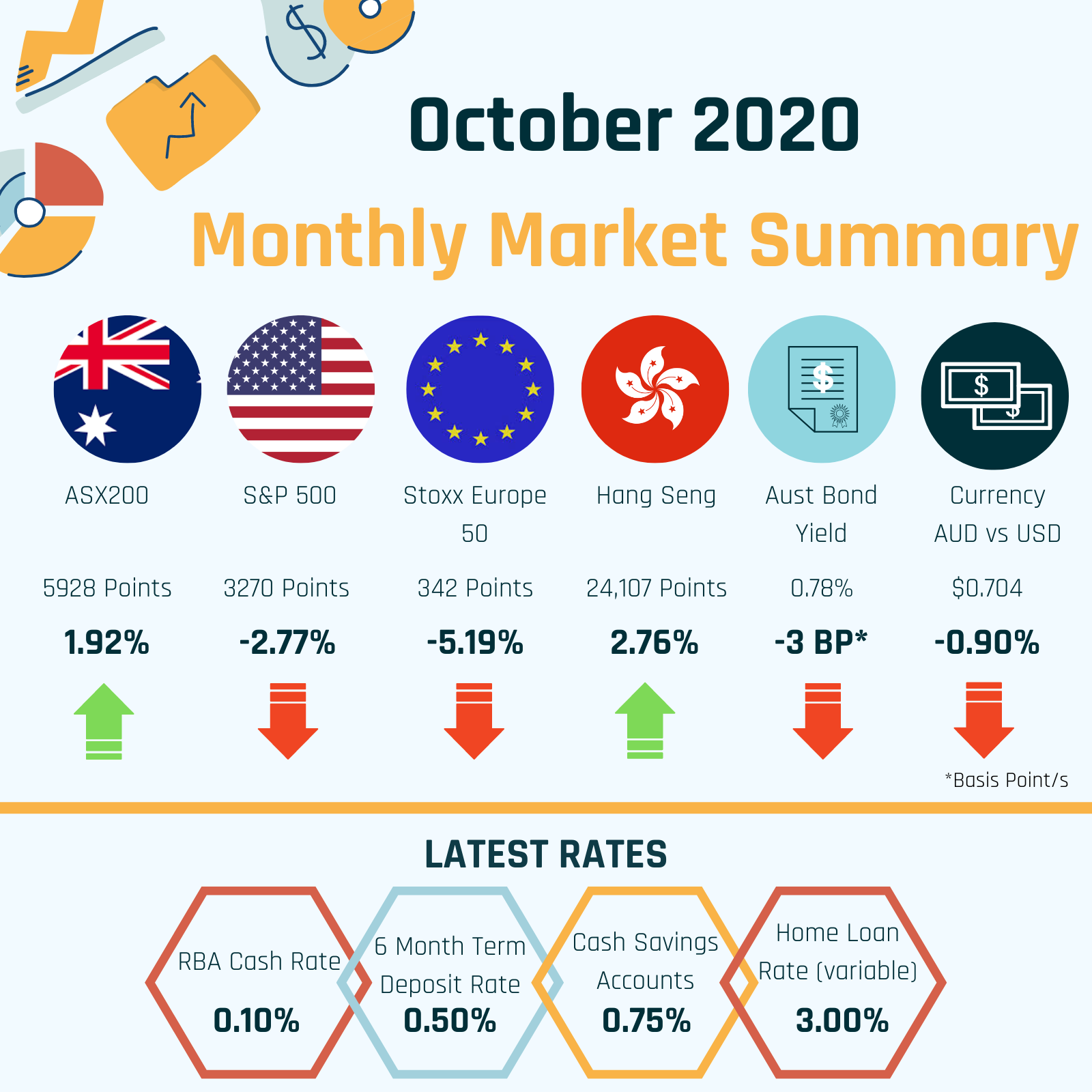

- In Australia, the RBA has reduced the cash rate to 0.10% in an effort to support unemployment and inflation. The cash rate is now almost at zero, however it is unlikely that the RBA would move to negative rates.

- The economic recovery in Australian is underway but containing small COVID-19 outbreaks will be key in the reopening of the economy.

- In Europe infection rates are rising as many countries experience a second wave. Many countries including the UK have re-entered lockdown, leading to falls in European shares.

- Chinese markets continue to outperform as they strongly recover from the pandemic. There continues to be trade tension between Australia and China affecting Australian exports. However, Australia has come to an agreement with 15 Asia-Pacific nations making the largest free trade agreement in the world. The move will help Australia to diversify their trading relationships away from China.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.