Solid earnings and expectations drive volatile but positive markets despite pandemic and political issues.

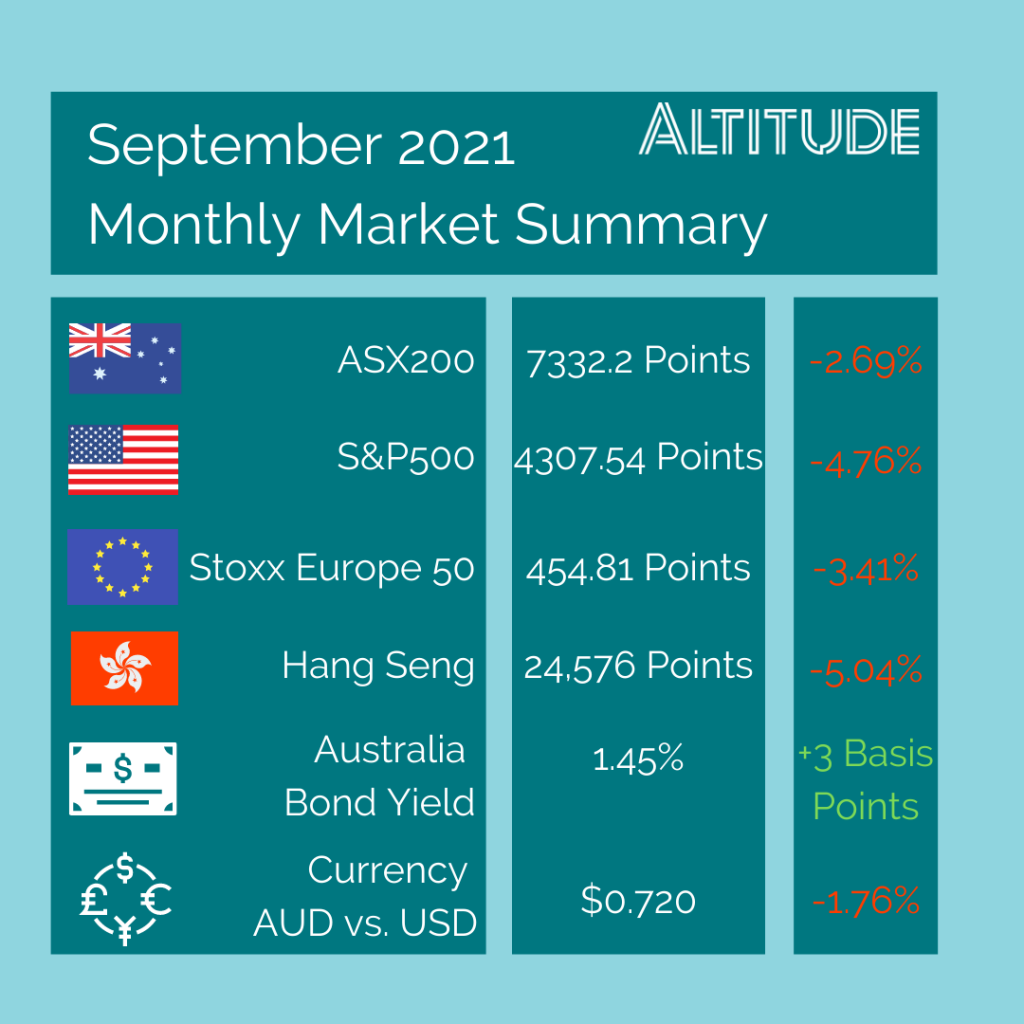

- Despite the global population of the fully vaccinated strongly increasing, and many developed countries continuing to remove restrictions, September saw a drop in share markets across the world. A key factor of this drop has been the supply disruptions continuing to increase the cost pressures on the economic restart of many companies. With transitory inflation lasting longer than first anticipated, many investors have started to take profits over the last month and become more cautious. The market will continue to be wary of supply disruptions.

- Whilst Australia is yet to witness the same the inflationary pressure of other countries such as the US, the ASX was also caught in the global sell off, down 2.69% after reaching record highs in August. As Australia is a significant exporter in the mining/materials sector, the drop in prices across this sector had big a impact on our market.

- Looking forward, we anticipate the easing of restrictions nation wide to provide a boost to the economy, particularly due to pent up demand; China is also building its production back up which has helped short term resource prices rebound from the September selloff.

- With Melbourne and Sydney remaining in some form of lockdown and a 70% double dose vaccination rate being set as the benchmark to reopen, September saw a significant increase in the vaccination rate across the country in an effort to avoid lockdown. Beginning the month at a double dose rate of 36%, the country was able surpass the halfway mark finishing the month at 55% of the population fully vaccinated.

- The US is again in political tension a round its debt ceiling limit which is rapidly approach. If the deadline to pass an increase is missed, it is highly likely that the government will be unable to avoid a breach in the debt limit which could result in shutdowns. September saw a temporary extension which pushed the issue only out to December.

- The unemployment rate hit a 12 year record low of 4.6% during the month of September, however this is likely not an accurate indicator of where Australia sits with the participation rate also decreasing to 64.5% (meaning a number having stopped looking for work whilst lockdowns are in place, but may resume as Australia begins to open up) .

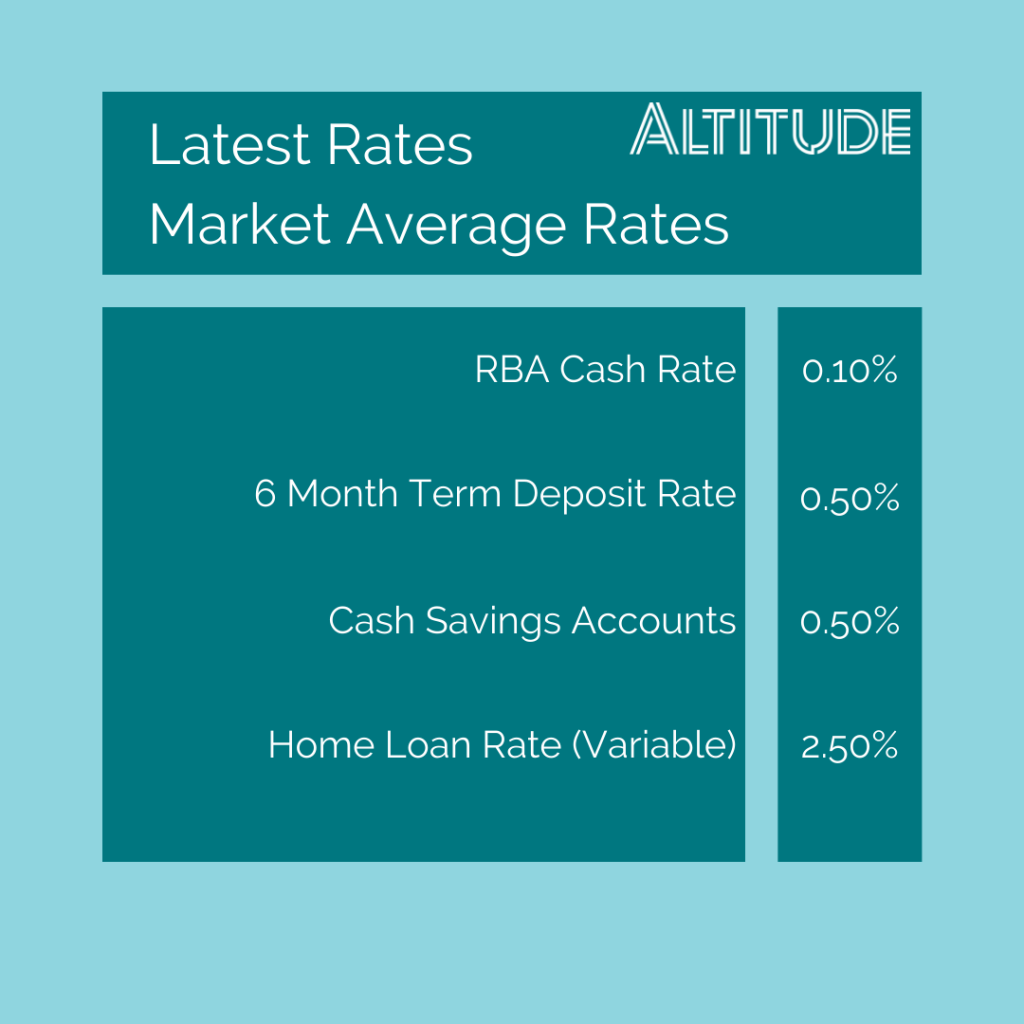

- The RBA continues to hold the cash rate at its record low and maintain their stance that it will not increase until inflation is sustainably between 2-3%. With Australia not seeing the inflationary pressure compared to other parts of the world, we do not expect the cash rate to increase for at least the next 12 months.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.