Key points

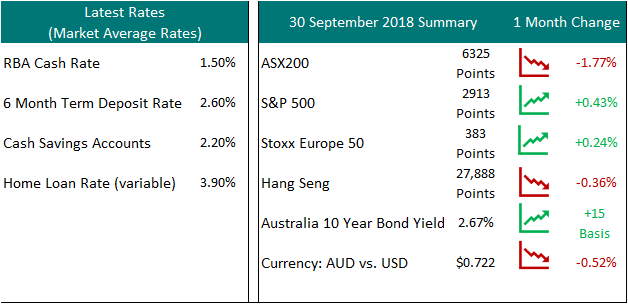

- Australian share markets fell in early September on the back of further fallout from the Banking Royal Commission and notable drops for healthcare stocks. This was further compounded by a greater fall in early October as part of a global rout of share markets.

- This was a result of investors reassessing portfolios as the US Federal Reserve continued to increase rates more than some anticipated, and global economic data indicated that growth around the world is slowing from its previous high rates. The outlook for most major economies, particularly the US, Europe, China and many emerging economies remains positive, having reached “peak” growth the outlook going forward is ‘growing but slowing’

- Over the coming months the three big themes that will potentially be the main causes of market volatility will be on the ongoing trade war between the US and China – and whether there may be any negotiations between the two countries before the next round of tariffs are imposed by the US on Chinese imports in early 2019. The other two are from Europe, with ugly Brexit negotiations going nowhere, and Italy in conflict with the European Union and its levels of debt and austerity measures.

- In Australia, business and consumer confidence remains fragile reflecting recent political uncertainty and mixed economic data. After a change in Prime Minister in late August, the Australian share market has not altered dramatically in relation to Scott Morrisons appointment; with Liberal Party economic policy not anticipated to change significantly from when he was treasurer. However, with the result of the previous Prime Ministers seat of Wentworth yet to be officially confirmed at the time of writing, the uncertainty of an anticipated hung parliament (with the coalition no longer holding a majority in the House of Representatives) is expected to weigh on business and consumer confidence further.

- Property price changes have also grabbed headlines, however there is a significant variation between states. Over 12 months Hobart prices have increased 15.5% (due to lack of supply) whilst Darwin, Sydney and Melbourne are all down. For Sydney and Melbourne, this is after significant increases over the last few years, whilst Darwin continues to cool from the decrease in mining investment.

- Tighter lending standards by banks are also having an impact on residential property, primarily for investment properties which are on interest only payments – with no capital repayment. Many banks are not renewing these types of interest only loans, forcing investors into higher repayments (or selling the property if they cannot afford the repayments).

- Given the heat has been taken out of the Sydney and Melbourne property markets, inflation remains within the RBA’s Targeted range of 2-3%, and unemployment continues to decline (albeit slowly), the RBA is not expected to make any changes to rates in the near term, however the next move is anticipated to be an increase.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.