The overriding focus of the budget is about transitioning the economy off unsustainable welfare payments (JobKeeper) via a heavy emphasis on policies that support job creation (JobMaker).

Tax cuts and welfare payments have been designed to be spent as quickly as possible and consumer-linked sectors are the obvious beneficiaries. The budget measures (tax cuts, asset write-offs) should support consumer spending through the Christmas period and see a broadening out of expenditure to businesses for larger items e.g. machinery, vehicles. The summary below details the key highlights for individuals in the following areas:

PERSONAL INCOME TAX

Tax Rate cuts

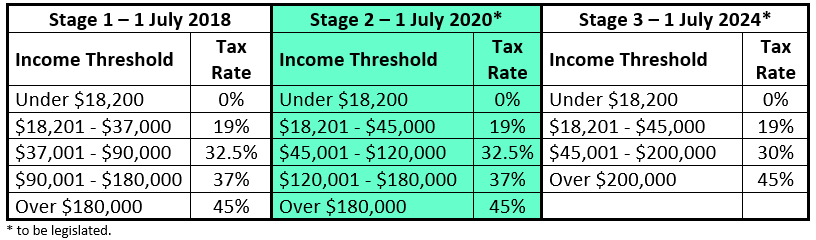

The core announcement, which was highly expected, will see already legislated ‘Phase 2’ tax cuts pulled forward from 2022 and backdated to July 2020. The 19% tax bracket will increase from $37,000 to $45,000 while the 32.5% tax bracket will increase from $90,000 to $120,000.

Below is a table summarising the 3 stage Personal Income Tax Plan:

* to be legislated.

Tax cuts would typically be available from the beginning of the next financial year, however injecting cash into the economy is the top priority with tax cuts to ‘go live’ as soon as December, just in time for the holiday season.

Income Tax Offsets

- The Low Income Tax Offset (LITO) will increase from $445 to $700.

- The increased LITO will be withdrawn at a rate of 5 cents per dollar between taxable incomes of $37,500 and $45,000. The LITO will then be withdrawn at a rate of 1.5 cents per dollar between taxable incomes of $45,000 and $66,667.

- Retain the separate Low And Middle Income Tax Offset (LAMITO) for the 2020-21 income year which provides a reduction in tax of up to $1,080.

- It provides a reduction in tax of up to $255 for taxpayers with a taxable income of $37,000 or less. Between taxable incomes of $37,000 and $48,000, the value of the offset increases at a rate of 7.5 cents per dollar to the maximum offset of $1,080. Taxpayers with taxable incomes between $48,000 and $90,000 are eligible for the maximum offset of $1,080. For taxable incomes of $90,000 to $126,000, the offset phases out at a rate of 3 cents per dollar.

SOCIAL SECURITY

Jobkeeper Payment Extension

The JobKeeper Payment extension announced on 21 July 2020 provides continued support until 28 March 2021, with the Payment targeted to those businesses that continue to be most significantly affected by the economic downturn. The level of the JobKeeper Payment is being tapered to enable businesses to transition towards their longer-term plans and a two-tiered payment is also being introduced to better match the Payment with the incomes of employees. The ATO will also be given additional resources to manage the JobKeeper and JobMaker programs.

COVID-19 Response Package — further economic support payments

The Government will provide $2.6 billion over three years from 2020-21 to provide two separate $250 economic support payments, to be made from November 2020 and early 2021 to eligible recipients and health care card holders. These payments are exempt from taxation and will not count as income support for the purposes of any income support payment. It will be eligible for recipients of the following payments and health care card holders:

- Age Pension

- Disability Support Pension

- Carer Payment

- Family Tax Benefit, including Double Orphan Pension (not in receipt of a primary income support payment)

- Carer Allowance (not in receipt of a primary income support payment)

- Pensioner Concession Card (PCC) holders (not in receipt of a primary income support payment)

- Commonwealth Seniors Health Card holders

- Eligible Veterans’ Affairs payment recipients and concession card holders.

HOUSING

First Home Loan Deposit Scheme (FHLDS)

The popular scheme will be expanded. The scheme allows first home buyers to purchase a new home with a deposit as low as 5%, without paying lenders mortgage insurance. The FHLDS has helped those with low deposits (<20%) enter the housing market while also supporting the construction industry.

The FHLDS has proved extremely popular with the first two rounds of 10,000 places (20,000 total) allocated within months. The second round of the FHLDS, which only launched on 1 July 2020, has already seen many of the approved lenders reach their full allocations.

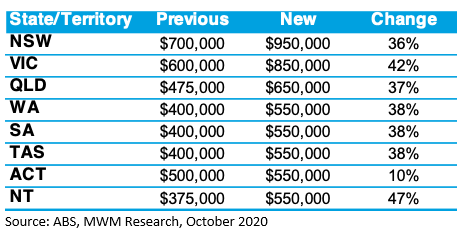

A further 10,000 places will now be allocated for the 2020-21 financial year. The price cap will also be significantly increased which should see the scheme broaden out to new regions and postcodes.

First Home Loan Price Caps receive boost

Source: ABS, MWM Research, October 2020

Capital Gains Tax and Granny Flats

Capital gains tax (CGT) will no longer apply if building a granny flat for elderly Australians or those with disabilities. This should benefit houseowners with elderly relatives and provide further support for the construction industry.

SUPERANNUATION REFORMS

No changes to key elements such as contribution caps, nor any extension of the minimum pension payment % discount past the 20-21 financial year, focus is on reforms to reduce multiple accounts when switching jobs and not allocating to underperforming funds.

- A new superannuation account will no longer be created automatically when a worker starts a new job. Instead, superannuation will be ‘stapled’ to the worker. Expected to save workers ∼$3b over 10 years.

- Super funds will be subject to performance tests with a requirement to inform members of underperformance. Expected to save workers ∼$11b over 10 years.

- Launch of YourSuper online website enabling easier comparison of fees and performance across super funds.