Reduced minimum pension withdrawal

With the ever-changing circumstances due to COVID-19 the government has introduced several measures to reduce the financial impact this will have. One of these measures is to reduce the minimum pension withdrawal for the current financial year and extend this to next financial year as well.

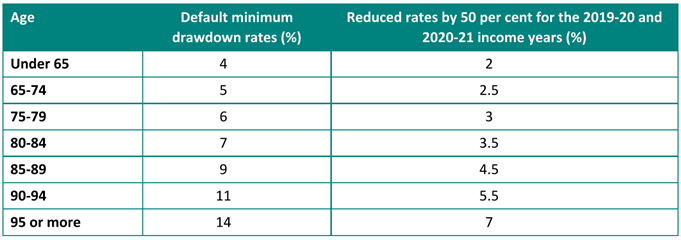

As of the 23rd of March, the minimum withdrawals have been reduced by 50% for all pension accounts. The new minimums are shown below:

The government has done this in order to reduce the amount of share sell downs. Selling at lower prices not only means losses are crystallised but also reduces the ability for your portfolio to recover when stocks do bounce back.

If you have been withdrawing the minimum amount each month since July 1 under the new rules you do not have to withdraw any more funds until next financial year. For pension account holders that receive their payment at the end of the financial year you will be able to reduce this withdrawal by 50%.

Therefore, we recommend that if you have ample cash savings to cover your expenses you should consider reducing your current withdrawals to take advantage of this new measure.

Please contact your adviser to discuss or if you would like to implement this change.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.