The Australian dollar has continued to come off against most other developed countries. As commodity prices have fallen and exports to China being lower than hoped, Australia’s usual method of stabilising itself has not worked. Not to mention, the lower interest rates in Australia compared to the US and UK mean investors are keeping their cash elsewhere.

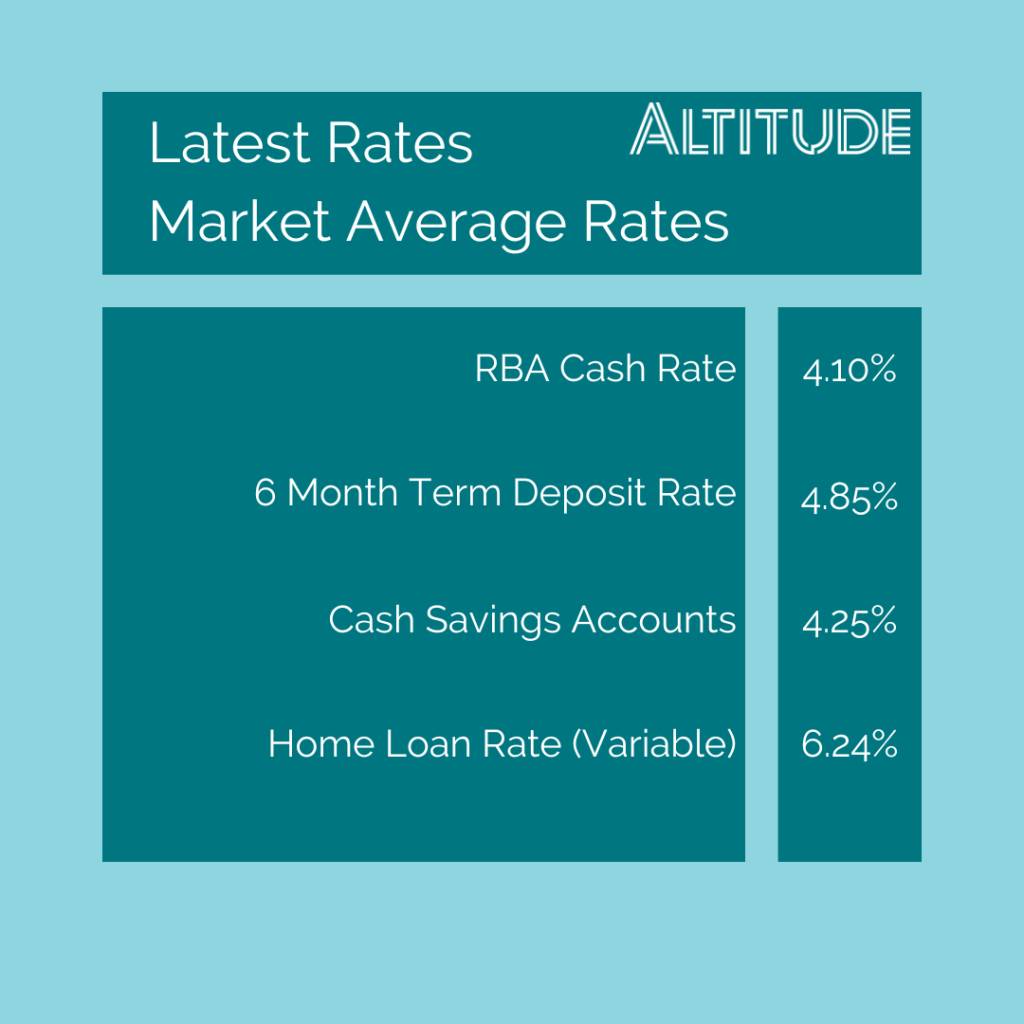

The RBA continued to hold interest rates flat as inflation data once again came in better than anticipated and with Michelle Bullock now at the helm of the RBA, we anticipate that the current rate will remain. We do not anticipate any decreases in the near future and expect that those Australian’s currently struggling won’t see a reprieve until either

- the US decreases their interest rates

- or the Australian dollar strengthens.

Although there was no meeting for the Fed in August, all eyes continue to be on the US after their continued increase of interest rates in late July saw US rates at 5.25%-5.5%. With recent labour data being positive and if August’s inflation data is better than forecast when it is released in mid-September, this could provide the Fed with enough reason to take pause when they meet next in 2 weeks.

The world’s 2nd largest economy, China, had a poor month with the struggle for housing continuing, rising unemployment and their exports slowing as the population of the Western world has begun to slow on spending. However, with China’s ability to provide stimulus and the strong control of the Government, they can react significantly faster than most.

Looking to equity markets, all major indices fell which you expect in a slowing economy. However there continues to be significant volatility and markets continue to be expensive for the economic issues facing the world, as it is the retired generations who have the majority of wealth and have also been less impacted.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.