February is the start of reporting season and as expected, companies with good fundamentals, that were able to reach expectations; performed very well off the back of this. As many of these are Australia’s largest companies, this meant that domestic equities continued to rally and push all-time highs further. With Australia continuing to be 6 months behind the US in it’s decision making, the Government is able to gain insight into the impacts of potential decisions, and for the time being doesn’t seem to be anything drastically stopping the performance of domestic equities.

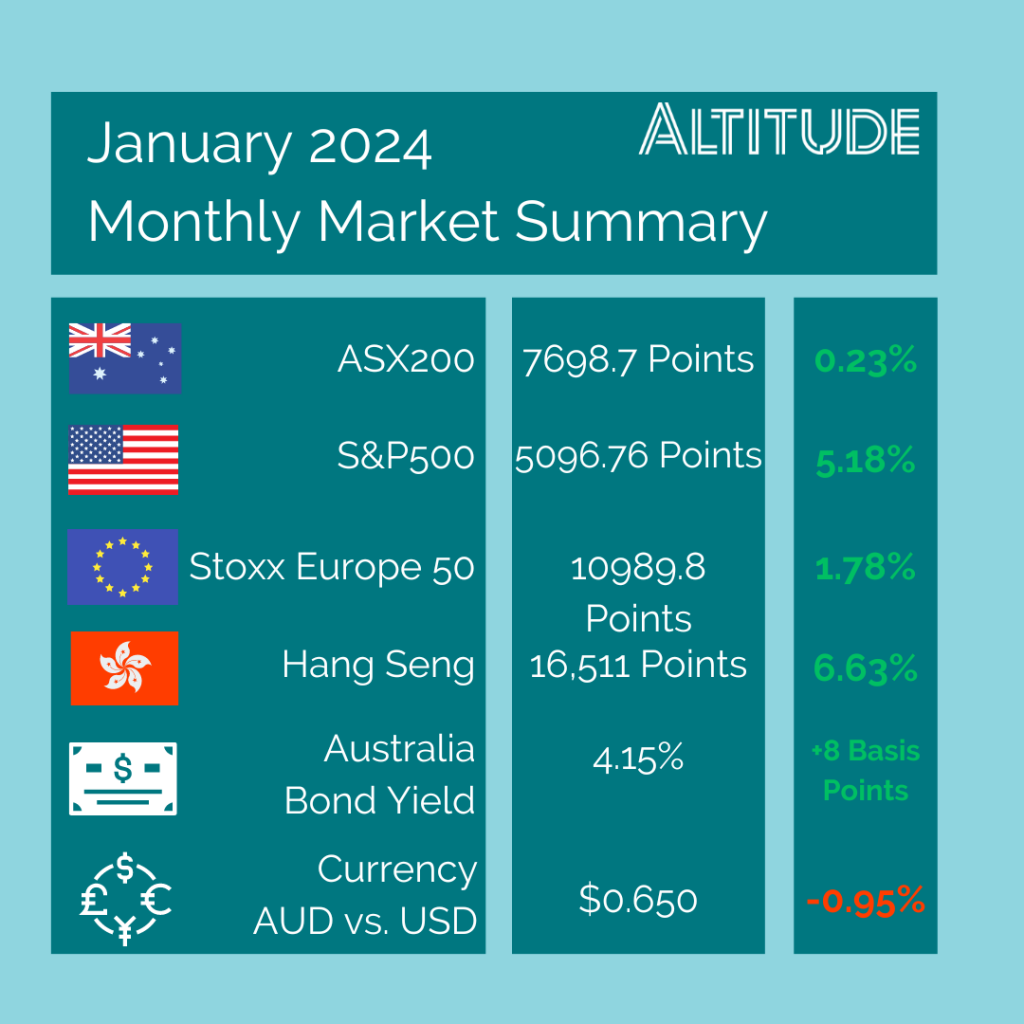

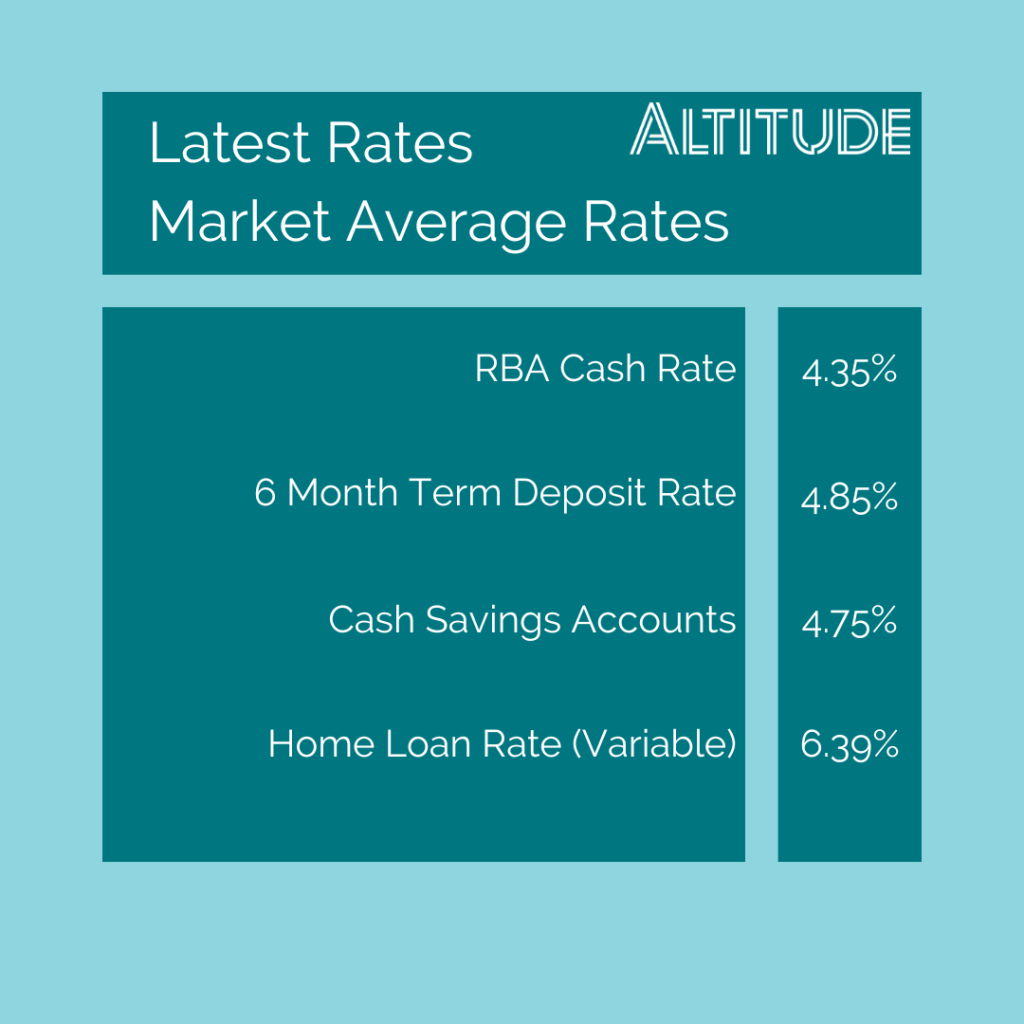

The Australian 10-year government bond yield increased again to 4.15%, however continues to remain below the RBA cash rate. Although an improvement, we still need to remain cautious on how long this remains under the cash rate. The unemployment rate slightly increased over February and although it is still hovering around full employment, will undoubtedly begin to be considered when the RBA next meet in April.

Global equities had another great month, with the US and Europe also continuing to push all-time highs further up as their economies continue to remain in good shape. Unlike recent months however, the Hang Seng was the strongest off the back of policies introduced to help boost investor confidence and a larger than anticipated cut to mortgage rates in China. If confidence continue to increase in Chinese companies, their very low valuations will be looked at for investors chasing growth. With the US economy looking to stick its soft landing, the Fed’s stance of not cutting rates too soon will likely be reaffirmed with recent inflation data still showing price pressure. Although they will likely continue to cut rates in the middle of the year, the economy is holding up and as a result the USD has strengthened over the last month.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.