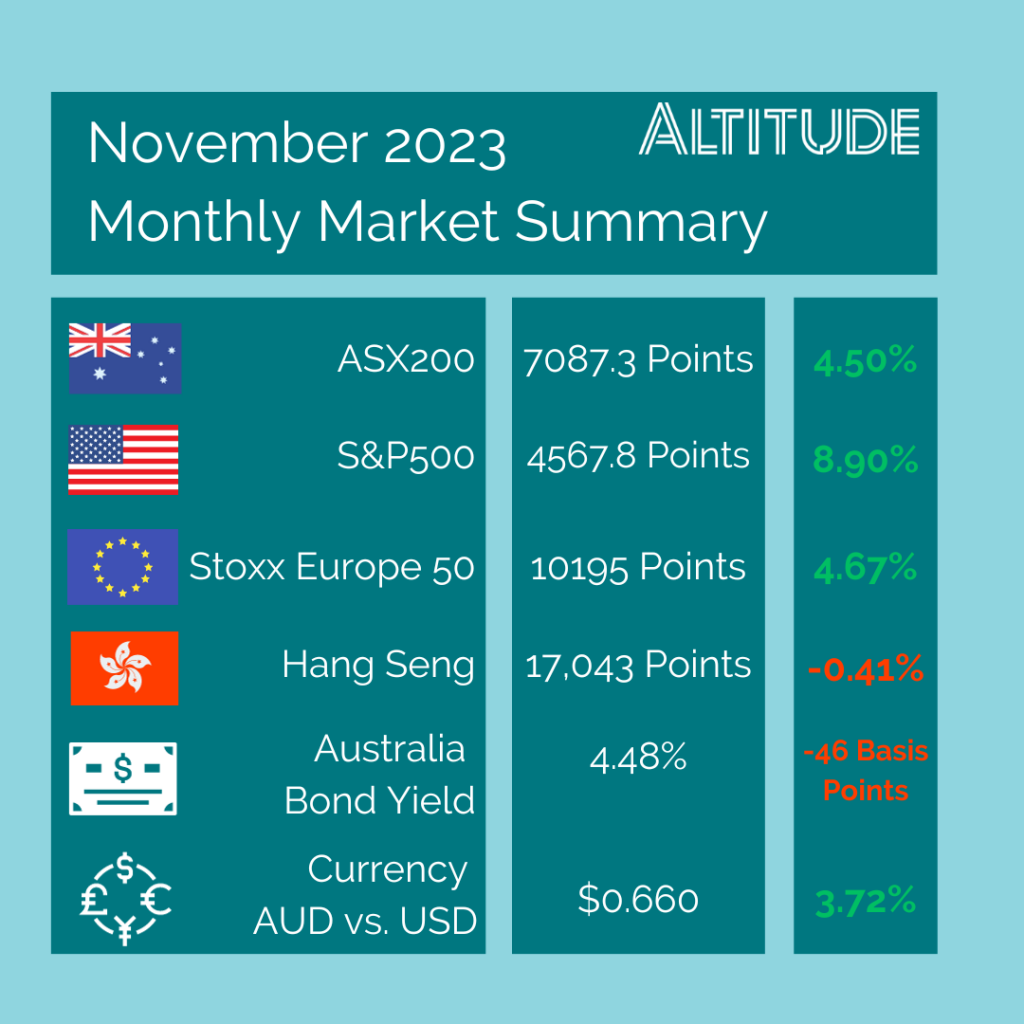

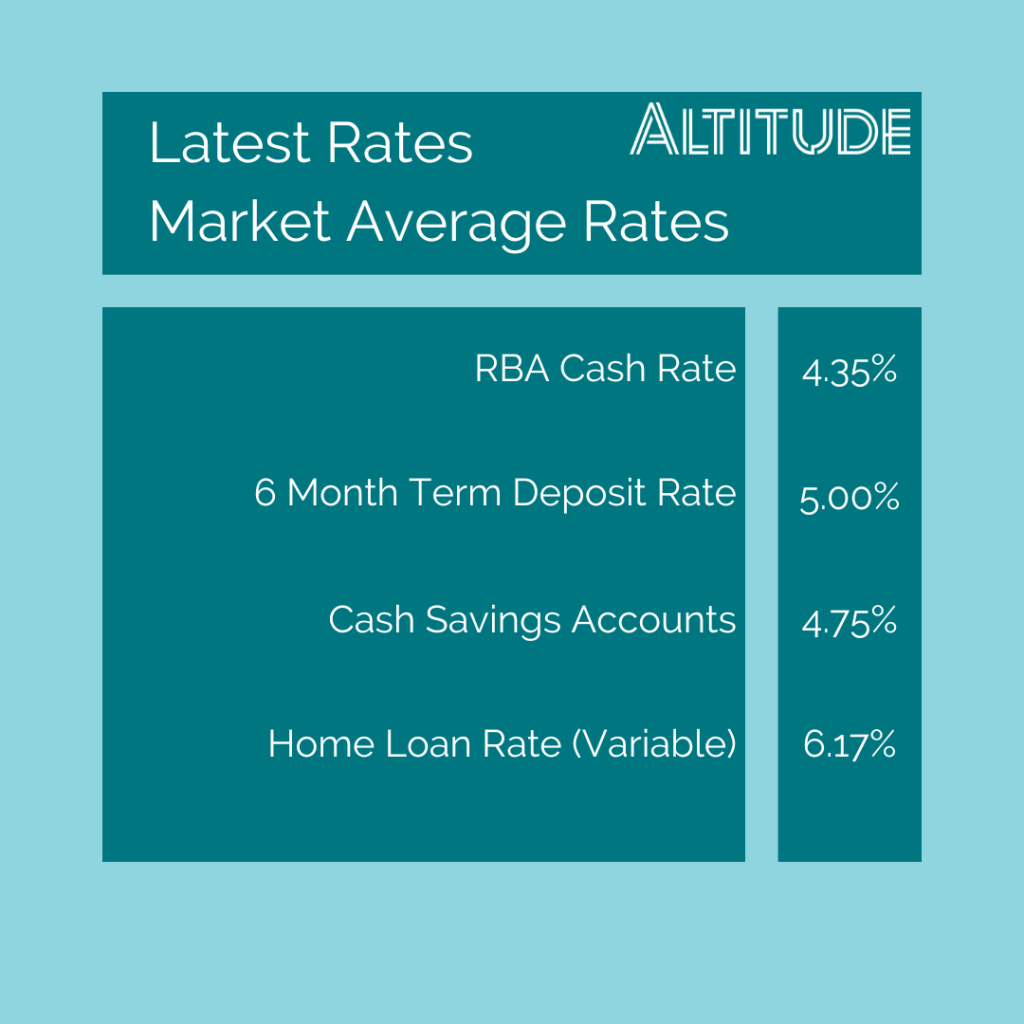

November continued to be all about interest rates for the economy, however all of the talk was how this impacts the fixed interest sector, compared to it’s impact on equities. The RBA provided some reprieve heading into the holidays as they held rates at 4.35%, as limited information meant they couldn’t justify an increase. This was priced in by markets from early November and the ‘higher for longer’ sentiment started to fade, seeing the ASX begin to recover and now sits above 7100 again. We expect that when more financial and economic information is available in the new year, markets may react strongly either way, for good or bad.

Bond yields slid through November and may look to slide further as interest rates in developed countries look to be cut earlier than anticipated. The Fed and European Central Bank looks to have peaked on interest rates, particularly with inflation figures now reaching the upper limit of their target range and most recent figures being better than consensus. This has resulted in economists and markets now expecting interest rate cuts to begin significantly earlier than expected. It is important to note however, that last month the ‘higher for longer’ sentiment was not questioned and with little information coming to light since last month, we may now be heading into a ‘boy who cried wolf’ on when interest rates begin to ease. With the RBA increasing rates first week of November, the Australian dollar continued to strengthen against the USD and Yuan, while remaining flat with the Pound.

As seen through much of the year, US equities have continued to see-saw depending on the confidence in the Federal Reserve. With the US economy looking to be on the right path for a soft landing, the S&P500 and Nasdaq were positive over the month. The S&P500 is back to levels seen in July/August of this year and remains expensive regardless of if they can pull off the soft landing. A similar story is seen in regions in a similar stage of the cycle. In fact only the Hang Seng decreased through November, as China is navigating a completely different set of problems. Continue to expect volatility in the coming months, as global economies feel the pressure of slowing down.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.