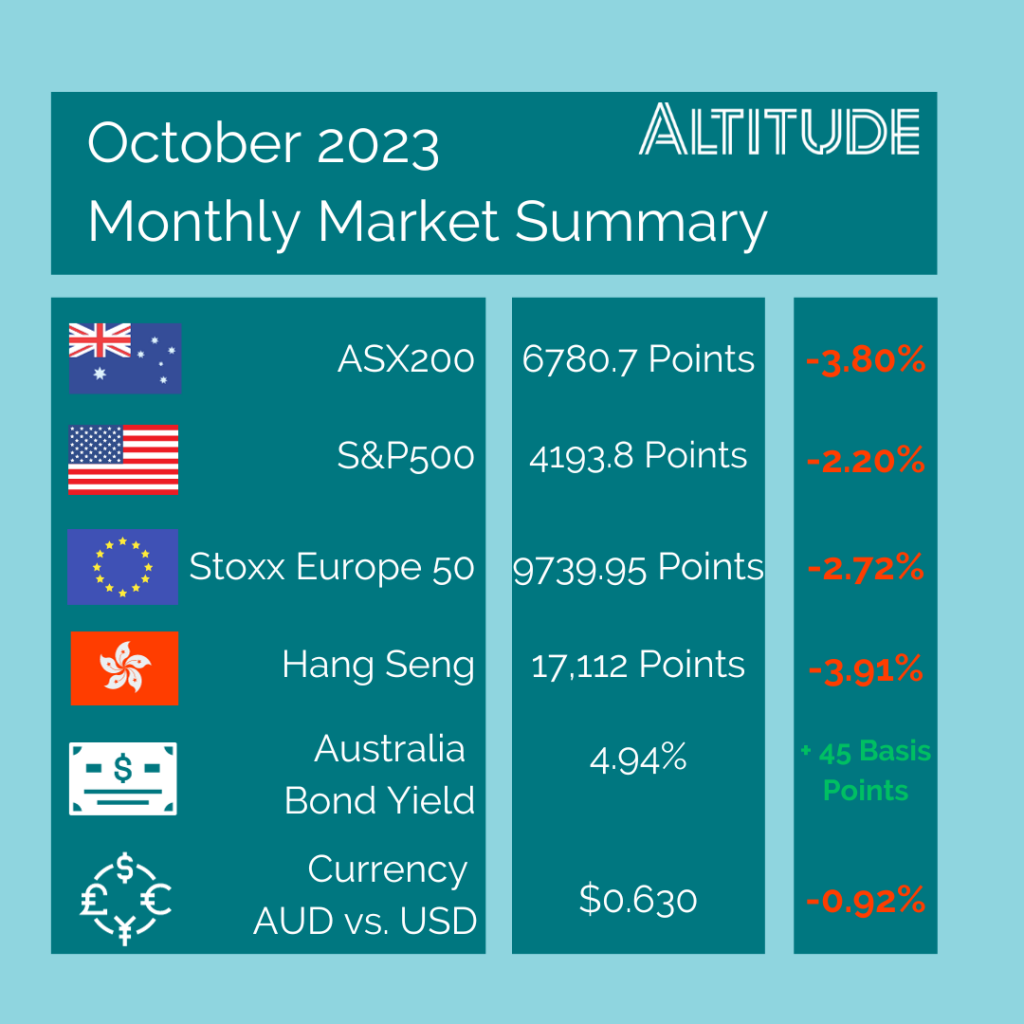

All major equity market indices fell further through October as volatility continues to impact monthly figures. As mentioned last month, the market remained expensive for the economic issues that continue to be present.

Bond yields continued to surge in Australia with the ‘higher for longer’ looking clearer with another rate rise by the RBA. However, yields for the US 10-year bonds have started to come off as the market sees an end to the Fed’s rising. Look for investors to continue taking advantage of these cheap bond prices while also providing more security to their portfolios.

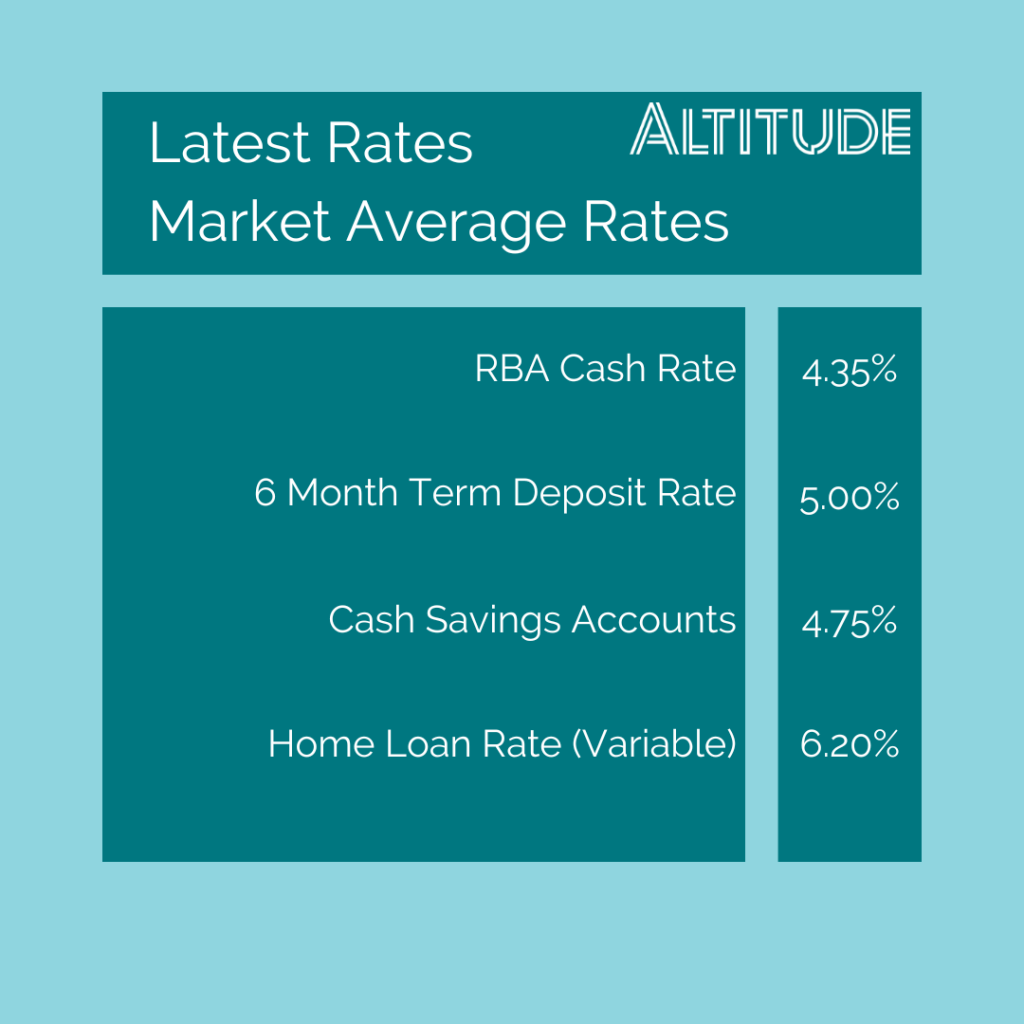

The official inflation figures for the quarter came out and as we were concerned about, are worse than anticipated. Australian investors immediately began pricing in today’s rate rise, however, began recovering to end the month. With today’s rate rise taking the cash rate to 4.35% and the first move since June, we would anticipate that Australian equities will retreat, however could be the catalyst to stop bond yields retreating.

RBA speculation of future rate rises part way through October and the US pausing for a second consecutive time saw the Australian dollar begin to turn and is recovering nicely against most major currencies (USD, Yuan, Pound). We are also nearing 10-year highs against the Japanese Yen.

Although in the US, September inflation figures were higher than expected at 3.7%, the Fed has continued to hold rates. The higher inflation data spooked investors, seeing the market take a hit to finish the month of October, however this decrease has already been negated by the strong start to November from the Fed’s confidence. Having been more hawkish for longer, they may be able to handle the inflation being slightly above expectations without raising rates. Something to be concerned about though is if they are stuck in the cycle the RBA has found itself in, with having to raise rates again after pausing and the volatility this causes in markets.

With the long running tensions in the Middle East escalating to war in the last month, oil prices could continue to remain higher, although they have come off to end October. As the war continues to evolve and the potential of other nations joining continues, we expect unforeseen economic impacts coming to light. We won’t be able to understand the impact on markets and economy until they begin to unfold.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.