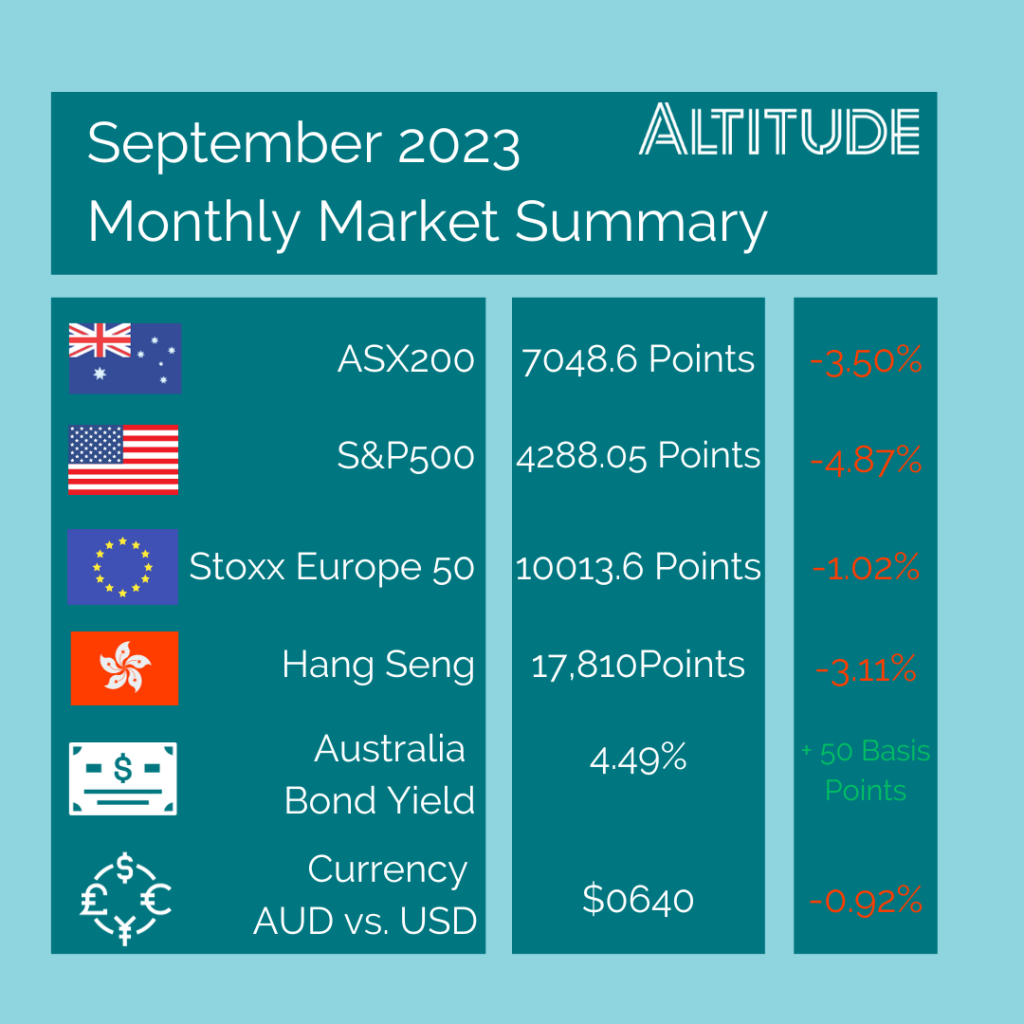

All major equity market indices fell further again through September as volatility continues to impact monthly figure. Markets continue to be expensive for the economic issues facing the world, as it is the retired generations who have the majority of wealth and have also been less impacted.

Bond yields have surged globally with the interest rates being ‘higher for longer’ message seeming to be sinking in. This will be followed with further volatility in equities as investors look to take advantage of cheaper bond prices.

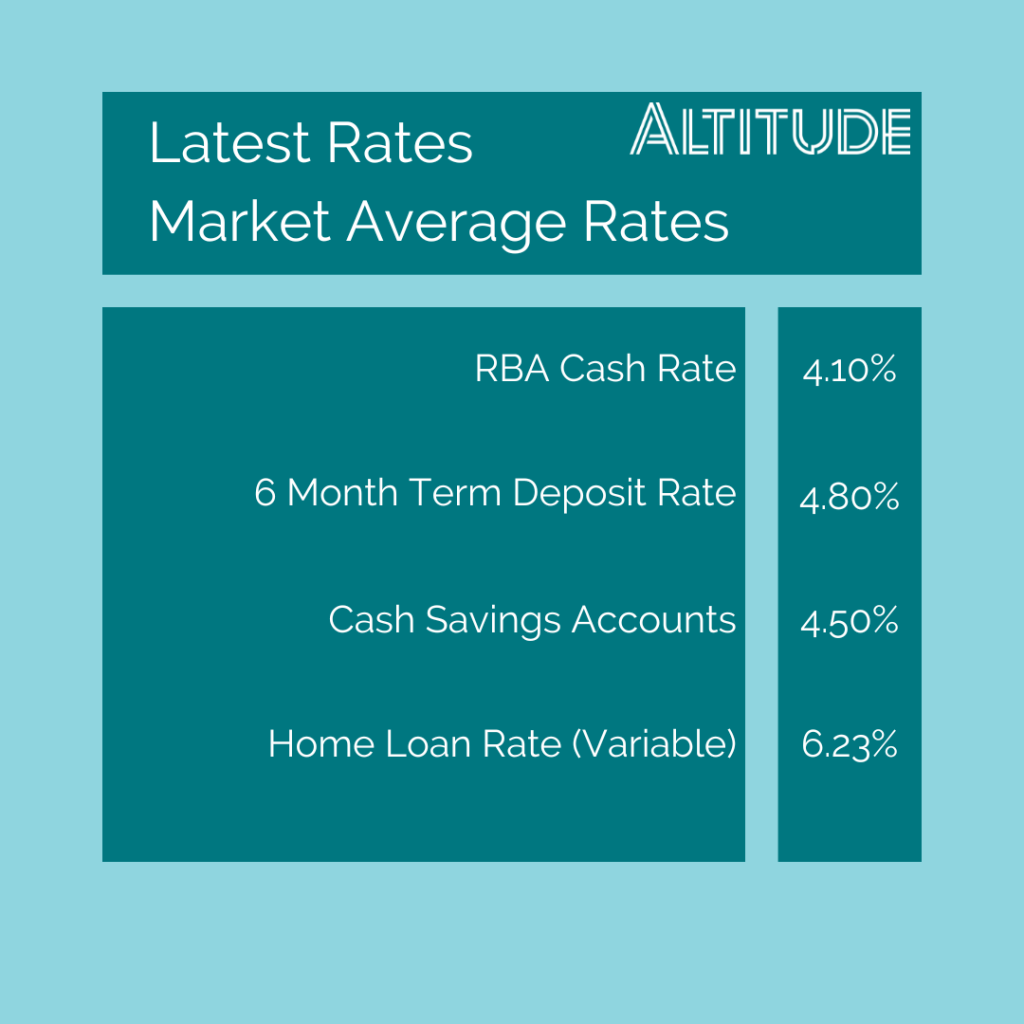

In her first meeting as Governor of the RBA, Michele Bullock kept interest rates on hold. However, there is concern over potential future increases as monthly inflation accelerated to 5.2%. With the official September CPI figures coming out in October, it is likely that it will be a tougher decision next month.

The increase to inflation is primarily due to oil price increasing 26% since the beginning of the financial year. Although it has come off slightly over the past week, it is still sitting above $90 USD per Barrel. This is reflected in petrol prices and consumers will continue to experience this.

The Australian dollar has continued to fall, sitting historically low against all the major currencies (USD, Yuan, Pound), we have however held up against the Japanese Yen.

The Fed continued to hold rates in September and with recent inflation figures falling below 4% for the first time in two years, they could continue to pause in the foreseeable future. However, oil prices play a significant impact on this figure and we would look to see what happens in the coming months. We are also now almost 12 months out from the presidential election and would look for any increases to rates to occur well before the election race heats up.

China has continued to struggle out of its slump, with growth forecasts being reduced to the lowest rates in decades off the back of stagnant house prices, higher debt levels and a drop in retail sales. However, with the government yet to provide much fiscal support it is unlikely that the slowdown will become out of control. With China recently starting their longest holiday break of the year, Chinese consumers have the ability to significantly turn the economy around in the first week of October.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.