A lot of people seem to think you have to have a complex/exciting investment strategy to build your assets so that you can have an attractive retirement, however this may involve a higher level of investment risk, the need to borrow to invest – all of which may leave somebody with higher levels of stress and uncertainty of how their investments perform over the long term.

If you wish to have lower levels of stress and a simplified investment strategy – might I suggest the boring strategy of Saving to Invest.

The maths behind Saving to Invest

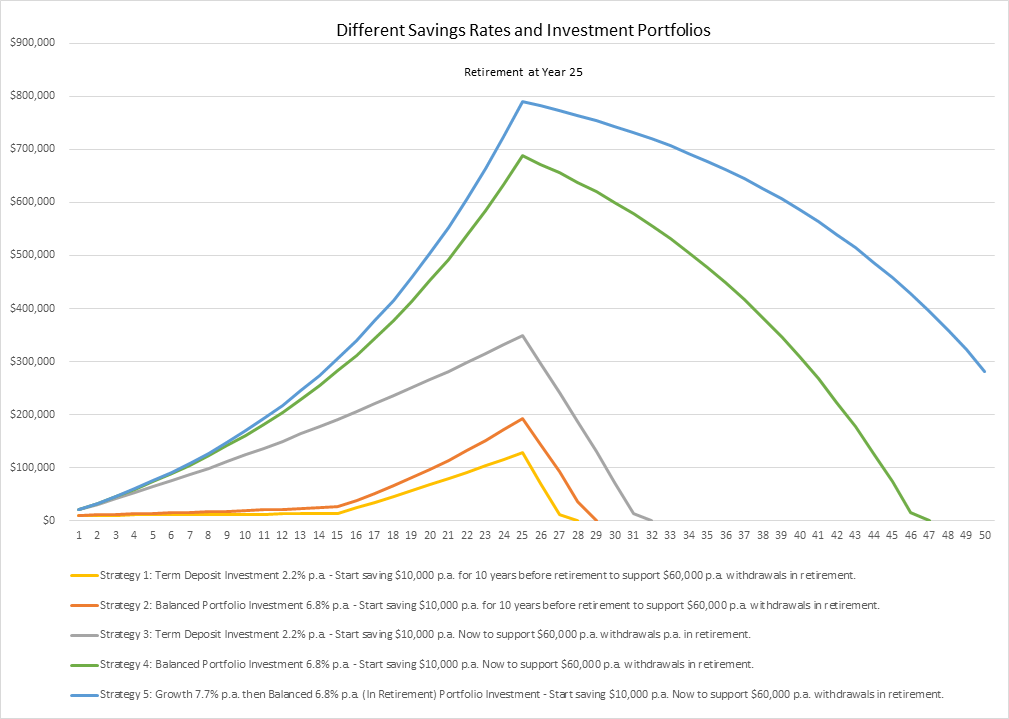

Instead of just talking about it, how about we look at some examples. Below I have summarised a basic investment projection with a starting balance of $10,000 using:

- conservative earnings rates

- utilising savings or finding ways to release/redirect cash flow for investment

- and illustrating the power of starting a savings and investment plan earlier – makes a dramatic difference in retirement.

The projections have been based upon the following different example scenarios:

- Scenario 1: Term Deposit Investment 2.2% p.a. – Start saving $10,000 p.a. for 10 years before retirement to support $60,000 p.a. withdrawals in retirement.

- Scenario 2: Balanced Portfolio Investment 6.8% p.a. – Start saving $10,000 p.a. for 10 years before retirement to support $60,000 p.a. withdrawals in retirement.

- Scenario 3: Term Deposit Investment 2.2% p.a. – Start saving $10,000 p.a. Now to support $60,000 p.a. withdrawals p.a. in retirement.

- Scenario 4: Balanced Portfolio Investment 6.8% p.a. – Start saving $10,000 p.a. Now to support $60,000 p.a. withdrawals in retirement.

- Scenario 5: Growth 7.7% p.a. then Balanced 6.8% p.a. (In Retirement) Portfolio Investment – Start saving $10,000 p.a. Now to support $60,000 p.a. withdrawals in retirement.

As you can see the above graph illustrates how starting to save earlier then just leaving it to the last 10 years before retirement can make a dramatic difference on the longevity of your retirement assets.

The other point to make is that in order to achieve more attractive risk-adjusted return over the long-term you really need to have your money invested in a diversified portfolio rather than just leaving it in cash or term deposits. With long-term retirement investment strategies, generally you have the ability to ride out any short-term volatility so that you can achieve an attractive risk-adjusted long term return.

Do you have the cash flow to start an investment strategy?

The above scenarios illustrate that someone with surplus cash flow can have the ability to implement such an investment strategy.

However, if you feel that you may not have any cash flow to start such a strategy, then don’t despair – there may be other avenues that a financial adviser may be able to identify to help start building your assets (for example – restructuring your cashflow needs, tax reduction strategies where tax savings can be invested, debt restructuring…)

If you would like someone to help with identifying you currently cash flow situation, and also identify opportunities where you could release/redirect some cash flow to further build your assets, then please get in contact with one of our advisers.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.