The overriding focus of the budget is about transitioning the economy off unsustainable welfare payments (JobKeeper) via a heavy emphasis on policies that support job creation (JobMaker).

Small to Medium Businesses (SMEs) are the key to this budget with the government providing increased tax incentives designed to encourage Australian businesses to invest in growth and job creation.

The summary below details the key highlights for business owners:

- Individual Income Tax Cuts

- Instant Asset Write-Off

- Loss Carry Back

- JobMaker Hiring Credit

- Apprenticeship Wage Subsidy

- Expanded Small Business Concessions

- FBT Exemption for Skills Training of Redeployed Employees

- Business Export Grants

INDIVIDUAL Income Tax Cuts

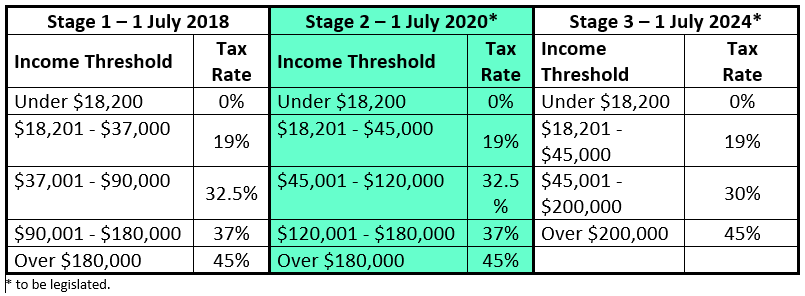

The Government announced that it will bring forward Stage 2 of the Personal Income Tax Plan from the 2019–20 Budget by two years, from 1 July 2022 to 1 July 2020. Under the revised plan the upper income threshold of the 19% personal income tax bracket will increase from $37,000 to $45,000; and the upper income threshold of the 32.5% personal income tax bracket will increase from $90,000 to $120,000.

The Low and Middle Income Tax Offset (LMITO) which is worth up to $1,080, will be retained until 1 July 2021.

The bring forward of the Stage 2 personal tax cuts by two years means people who earn:

- between $45,000 and $90,000 will have an additional $1,080 of post-tax income in 2020–21;

- more than $120,000 will have an additional $2,565 of post-tax income in 2020–21.

Stage 3 of the Personal Income Tax Plan remains unchanged and commences from 2024–25 as legislated.

Below is a table summarising the 3 stage Personal Income Tax Plan:

Instant asset write-off

The Government has announced it will support businesses with an aggregated annual turnover of less than $5 billion by enabling them to deduct the full cost of eligible depreciable assets acquired from 7:30pm (AEDT) on 6 October 2020 and first used or installed by 30 June 2022.

The 100% deduction applies to new and second-hand depreciable assets for small and medium entities, while larger businesses will receive the 100% deduction on new depreciable assets only. The cost of improvements to existing eligible assets will be 100% deductible.

Small businesses can deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies.

Larger business entities can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31 December 2020 under the enhanced instant asset write-off.

Businesses that acquired eligible assets for the pre-existing enhanced $150,000 threshold will have an extra six months, until 30 June 2021, to first use or install those assets.

Loss Carry Back

The Government has announced a temporary tax relief by way of a ‘loss carry-back’ mechanism which will allow eligible companies to “carry back” losses. Losses in the 2019-20, 2020-21 and 2021–22 financial years can be offset against tax paid on profits in the 2018-19 financial year onwards, providing a refundable tax offset in the year the loss is made.

Previously, tax losses could only be used to offset profits and save tax in financial years following the loss.

This measure will enable many distressed businesses to claim back the taxes they paid on their pre-COVID-19 profits against losses they are incurring during the current recession.

Eligible companies are those with an aggregated annual turnover of less than $5 billion.

JobMaker Hiring Credit

The credit will give businesses incentives to take on additional young job seekers. The credit will be available to employers for each new job they create over the next 12 months for which they hire an eligible young person, aged 16 to 35 years old to work an average of 20+ hours per week each quarter.

New jobs created from 7 October 2020 to 6 October 2021 will attract the credit for up to 12 months from the date the new position is created.

Eligible employers will be able to claim $200 a week for each additional eligible employee they hire aged 16 to 29 years old (up to a maximum $10,400 per new employee) and $100 a week for each additional eligible employee aged 30 to 35 years old (up to a maximum $5,200 per new employee).

To be eligible, the employee must have received the JobSeeker Payment, Youth Allowance (Other), or Parenting Payment for at least one of the previous three months at the time of hiring.

The credit will be claimed quarterly in arrears by the employer from the Australian Taxation Office from 1 February 2021. Employers will need to report quarterly that they meet the eligibility criteria.

Employers need to demonstrate that the job is additional and specific criteria must be met. The additionality criteria require that there is an increase in:

- the business’ total employee headcount (minimum of one additional employee) from the reference date of 30 September 2020; and

- the payroll of the business for the reporting period, as compared to the three months to 30 September 2020.

The amount of the hiring credit claim cannot exceed the amount of the increase in payroll for the reporting period. Total employee headcount on 30 September 2020 and payroll in the three months to 30 September 2020 represent the baseline values for the employer. The baseline headcount will be adjusted in the second year of the program to ensure an employer can only receive the credit for 12 months for each additional position created.

APPRENTICESHIP WAGE SUBSIDY

The JobMaker Plan announced in the 2020 Budget includes the Boosting Apprentices Wage Subsidy (replacing Supporting Apprentices and Trainees (SAT) subsidy).

All businesses are eligible to access the subsidy from 5 October 2020 to 30 September 2021 for apprentices and trainees commencing employment. The subsidy is capped at 100,000 places and provides businesses with a reimbursement of up to 50% of the apprentice or trainee’s wages up to $7,000 per quarter.

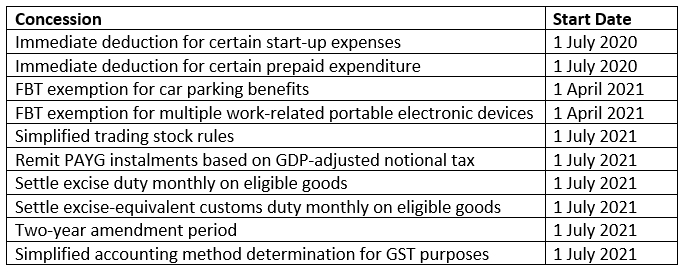

EXPANDED SMALL BUSINESS TAX CONCESSIONS

The Government announced that it will expand access to a range of small business tax concessions currently available only to small business entities with turnover under $10 million.

Under the measures, businesses with an aggregated annual turnover between $10 million and $50 million will have access to the 10 small business concessions set out in the table below.

FBT exemption for skills training of redeployed employees

From 2 October 2020, an exemption from fringe benefits tax (FBT) will be available for employer provided retraining and reskilling benefits provided to redundant, or soon to be redundant employees where the benefit is not related to their current role.

Currently, FBT is payable if an employer provides training to its employees that is not sufficiently connected to their current employment. By removing FBT, employers will be encouraged to help workers transition to new employment opportunities within or outside their business.

The exemption will not be available for:

- retraining acquired by way of a salary packaging arrangement; or

- training provided through Commonwealth supported places at universities or extend to repayments towards student loans.

BUSINESS EXPORT GRANTS

The Export Market Development Grants (EMDG) Scheme is the existing export support program that offers businesses a reimbursement of up to 50% of their eligible overseas promotion expenses up to a maximum grant of $150,000 per year over eight years.

While more details are to be drafted, the following proposed changes are set to reduce eligibility criteria and grants available:

- Eligibility turnover threshold decreasing from $50 million to $20 million

- Applying for funding prospectively instead of retrospectively

- Implementation of a three-tiered system:

- SMEs new to export accessing up to $80,000 over two years ($40,000 per year)

- Eligible exporters planning to expand in current markets or enter new markets will be able to access up to $240,000 over three years ($80,000 per year)

- Eligible exporters who continue to expand into new markets will be able to access up to $450,000 over three years ($150,000 per year).