In recent years, the topic of ethical and sustainable investments (known collectively as Responsible Investing) has moved from being a peripheral offering to the mainstream. Many fund managers now have dedicated options committed to sustainable practices and responsible investments.

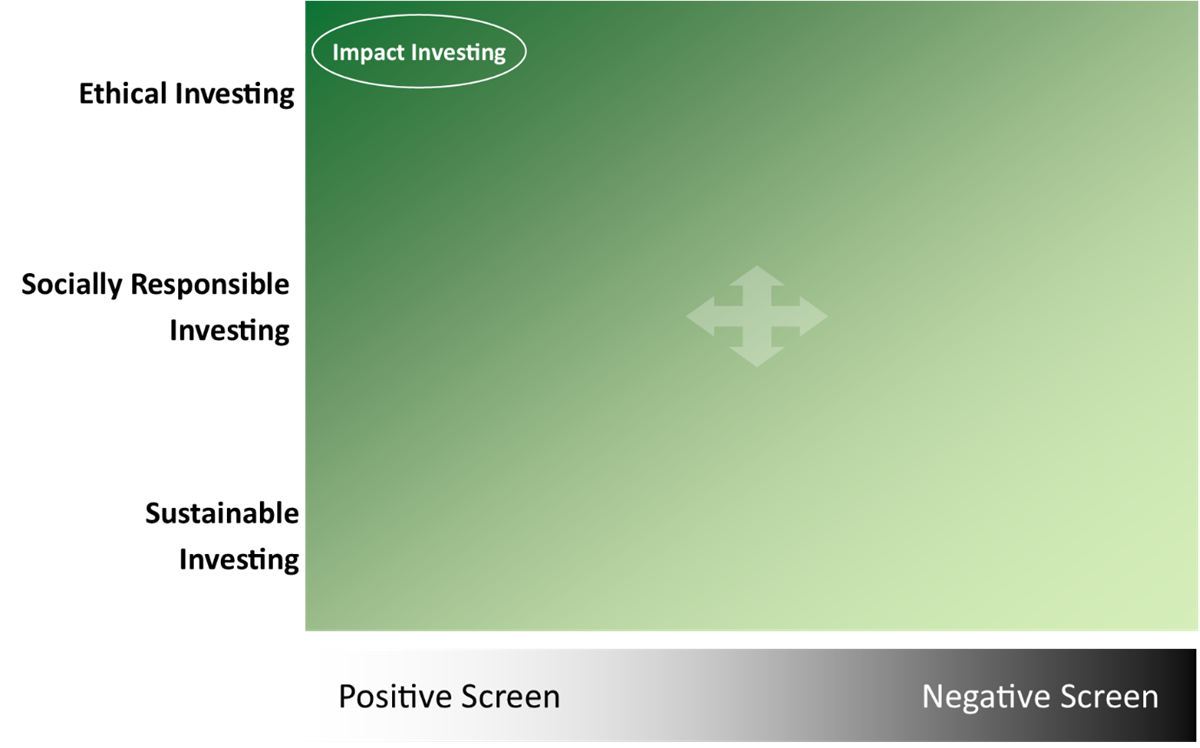

It can be very hard to know what you are investing in as there are a number of specific terms such as; ethical investing, environmental, social and governance (ESG) criteria, socially responsible investing and sustainability investing, and these things can mean different things to different people. As a result a good approach is to see Responsible Investing as a spectrum from “deep green” to “light green” products that let you invest according to your level of conviction, per the diagram below:

As part of this process Positive and Negative Screening methods are used to filter how investments are approached. Positive Screens are where the investment manager looks to identify companies that have a positive social or environmental impact. Whilst Negative Screening avoids companies and sectors (or even, at times, countries) that have a negative social impact (e.g. gambling, tobacco, pornography, mining).

Responsible Investments are generally classified via three methods and may use the negative and/or positive screens to determine how the investments are selected.

- Ethical Investing:Generally both Negative and Positive screening is used for Ethical Investing, with the screening more strict and an emphasis placed on positive screening, resulting in a portfolio which will often have exposure to areas such as education or healthcare. Depending on the conviction and application of filters, this process could also result in a company being excluded not because of a negative screen, but it may not have a positive impact and is therefore considered neutral.

- The full extent of using a positive screen is ‘Impact Investing’ which focuses on businesses with a distinct social or environmental purpose such as an emphasis on improving social outcomes, or renewable energy.

These are ‘deep-green’ types investments, and due to the extra screening requirements are often costlier.

- Socially responsible investing:Companies are generally screened out if they take part in excluded activities, but may be included if their commitment to social responsibility outweighs the negative aspects (for instance, a company such as Woolworths generates some of its profit from gambling/poker machines, some managers may screen Woolworths out completely, whilst others may say if it only accounts for less than 5% or 10% of profit it can be included).

These are in the middle of the spectrum, and these types of ‘mid-green‘ investments generally cost less.

- Sustainable investing:Investments are chosen on the basis of how well a company manages environmental, social and corporate governance (ESG) factors, not on what the company makes or sells. Essentially, this is investment managers reviewing a company and determining how it’s run and how it manages the environmental and social impacts of activities, rather than just looking at ethical factors. The theory is that companies that do less harm, look after their staff and are well managed, will provide better returns in the long run.

These are light green on the Responsible Investment spectrum; many investment managers are starting to include this as part of their regular process to screen companies even if not positioning themselves in the ethical/socially responsible investment manager space.

Who determines what screening method is ethical?

In Australia the peak body is the Responsible Investment Association Australasia (RIAA). The organisation created a certification program, with a view to making uniform standards of disclosure for funds.

In order to gain approval, investment managers must apply to the RIAA and demonstrate there is a specific methodology in place to weed out unethical behaviour. The process is then independently verified by an accounting firm. Funds that qualify carry the RIAA certification symbol.

https://responsibleinvestment.org/program-overview/

What about performance?

Excluding profitable companies from your investment selection using the above filters does not necessarily mean detracted returns. A number of international studies have shown that where choosing responsible investing the coast is not large, with some reports finding its aids performance. Part of the reasoning is that companies with good ethical, social and governance policies (ESG) make better investments long term, this is because they avoid getting into legal and environmental issues, and have better focus on reducing waste and therefore costs.

Selecting the investments that are the right mix for your ethical and financial needs depends on what factors are most important to you. As part of your overall financial planning strategy, your Altitude financial adviser has the flexibility to include responsible investing into your investment/super portfolio, either incorporated as part of a regular portfolio or a pure ethical/socially responsible only mix. All managed funds currently within the Responsible Investment Portfolio are certified and approved by the RIAA.

Altitude Financial Planning is a Corporate Authorised Representative of Altitude Financial Advisers Pty Ltd

ABN 95 617 419 959

AFSL 496178

The information contained on this website is general in nature and does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and the relevant product having regard to your objectives, financial situation and needs. In particular, you should seek the appropriate financial advice and read the relevant Product Disclosure Document.